MBS Intelligence

Private Equity

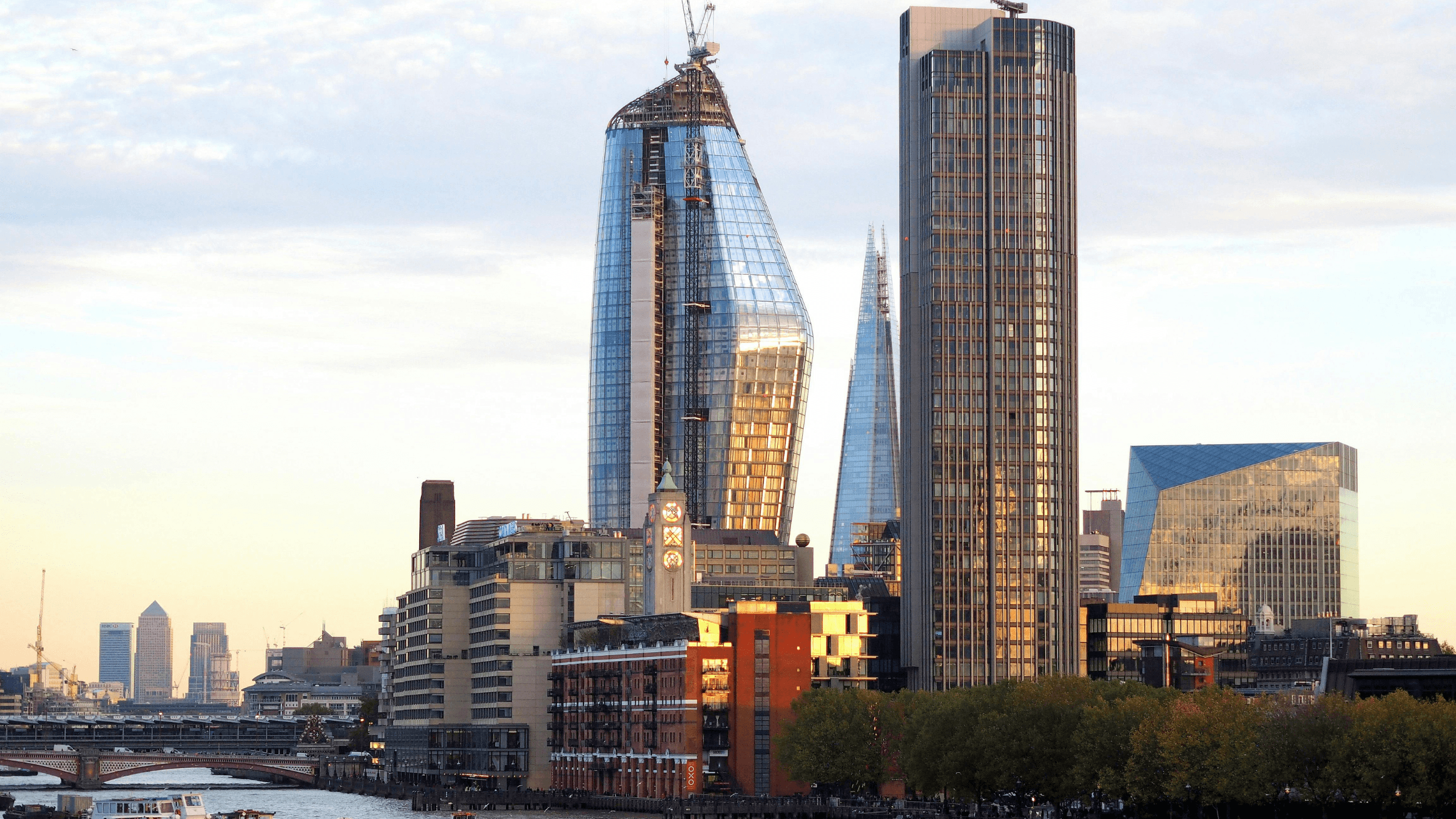

FTSE foibles: stopping London losing

2024 started with 98% of TUI shareholders voting to leave the London Stock Exchange in favour of a dual listing in Hanover and Frankfurt. The company, Europe’s largest travel operator (and a former member of the FTSE...

The future of M&A in beauty: why newness is…

The beauty sector may have reached peak saturation. Over the past few years, it has seemed like everyone – from online influencers to top-tier financiers – has staked their claim in the market, launching brands,...

PE and the EPL: The changing face of football…

August is a big month for football. The English Premier League kicked off last night, and in Australia, the quarter finals of the Women’s World Cup take place today. Against this backdrop, it feels like the right time...

Progress in private equity: tracking consumer sector investment priorities…

Last summer, The MBS Group undertook research to better understand how Covid-19 had impacted the private equity landscape in the consumer-facing sector. Our report – Responding to Covid-19: A new talent landscape, and...

Opportunity amid the disruption? Exploring private equity’s appetite for…

Covid-19 has caused never-before-seen disruption for the hundreds of private equity funds which invest in consumer industries across Europe. During this time, funds have been required to provide huge packages of...

The alternative asset class looks to alternative investment strategies

Private equity firms have more cash than ever before. The success of the asset class over the past five decades and the increasing difficulty of generating impressive returns in the conventional financial markets have...

The business case for investing in ethical companies

‘Ethical’, while not a dirty word in business, certainly has some way to go to rehabilitate its reputation in the corporate community. Though CSR initiatives and departments have multiplied in recent years, the fact...

Q&A with Level 20 founder Jennifer Dunstan

As part of my research for our latest white paper on the case for gender diversity in private equity, I spoke with Jennifer Dunstan, founder of Level 20, to talk about how the industry can, should, and is changing to...

The Case for Gender Diversity in Private Equity

At the SuperReturn conference in Berlin in 2017, Advent International managing director James Brocklebank got up on stage to declare ‘There not enough women in the industry’. Indeed, in 2017 the number of women in...

Latest Private Equity News

Private equity firms no longer considering Samsonite According to reports, private equity firms including Carlyle Group and KKR have lost interest in acquiring the luggage manufacturer Samsonite, due to its high valuation. Samsonite owns brands including High Sierra and American Tourister. Read more.

Forward Consumer Partners buys artisan bakery The US-based firm has announced the acquisition of Firehook Bakery, a fast-growing artisan bakery business. Pierre Abushacra, Firehook’s founder, will retain a significant minority ownership stake. Read more.

Sentinel Capital Partners-backed Captain D’s eyes UK debut US fast-casual seafood brand Captain D's has set its sights on the UK. The private equity-backed business, which operates 550 stores in the US, is exploring possibilities for a UK roll-out. Read more.

Private equity giant CVC plans €1.25bn Amsterdam listing One of Europe’s largest private equity groups has announced plans to raise more than £1.1bn in an IPO the Netherlands. CVC owns Authentic Brands Group and Lipton Teas as well as dozens of other consumer brands. Read more.

ICG backs travel insurance specialist London-based private equity firm Intermediate Capital Group has invested in the UK travel insurance business Staysure Group, which specialises in providing insurance for customers with pre-existing conditions. Terms of the deal were not disclosed. Read more.

NRDC Equity Partners and BB Kapital buy German department store business Galeria The investment firms have bought Galeria for an undisclosed sum, lifting the department store chain out of bankruptcy. Galeria currently operates 90 stores in Germany, generating €2.2bn in sales annually. Read more.

Join our network of executives who receive the MBS News daily, as well as the insights, analysis and our weekly column in The Weekend Edition.

You’ll be able to unsubscribe at any time.