The consumer healthcare sector is ripe for disruption. As technologies develop and patient expectations change, winning businesses will be those that renew their focus on customer service and evolve their propositions to cater to changing consumer demands. The impact of Covid-19 looks set to accelerate this process, driving digital transformation and overhauling the relationship between the patient and the healthcare provider.

While healthcare leadership most often comes from within the sector, it is our view at MBS that hiring exclusively from within healthcare could leave businesses ill equipped to creatively respond to the changing market – in particular in developing and executing the right customer centric propositions. Different leadership, with different commercial backgrounds and schooling, might be required to address these new challenges.

Perhaps most importantly, patients are looking to access healthcare and medicine in new ways. When lockdown restrictions kept everyone in their homes, digital health businesses were propelled to the forefront of the sector, fast-tracking the burgeoning trend for telehealth and online consultations. McKinsey estimates that global digital-health revenue, from telemedicine, online pharmacies, wearable devices and similar, will rise from $350bn last year to $600bn in 2024.

An example of this can be found in Push Doctor, the leading provider of remote consultations in the UK, which saw a 60% increase in new surgery partners in April. Another healthcare business told us that 95% of GP appointments booked through its platform were being untaken online, compared to 5% prior to Covid-19. Indeed, this shift to digital has in some cases forced businesses to rethink their entire strategies, with one company telling us that it was reducing the capacity of its physical sites by around 30% to focus on its online offering. Against this backdrop, healthcare businesses will need to hire more disruptive digital talent from the consumer-facing sphere, who can lead efforts to develop and roll out digital tools and services.

In today’s world, patients are also willing to spend more on healthcare treatments – and, in many ways, want to be treated as customers, not patients. This has a number of implications, both operationally and from a values perspective. Operating models are transforming, for example, to become more convenient for the consumer. While most healthcare businesses are still closed on Sundays, those that can provide services seven days a week are finding themselves rewarded with customers who are drawn to convenience.

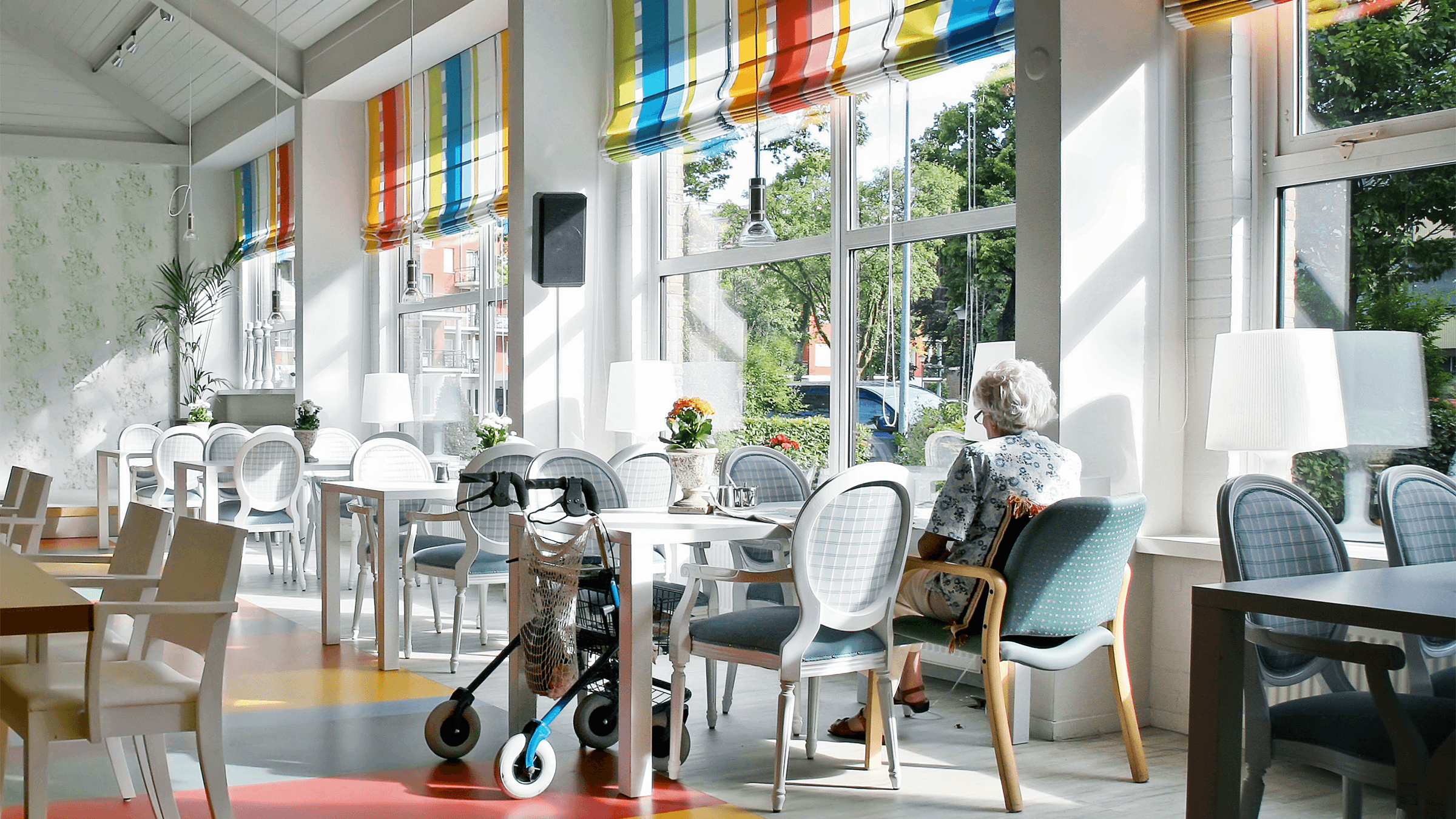

Moreover, health businesses are renewing their focus on customer service, across proposition, offering and the aesthetics of their products and sites. “In order to compete with the NHS,” one healthcare CEO explained, “you have to provide a five-star treatment that focuses on customer experience.” A CEO of a care home echoed this sentiment, noting that the entire sector has seen a shift: “Care used to be very old fashioned,” he said, “there was a lot of blame culture, very little customer service and limited regulation. We’ve moved the dial since then, and now it’s about customer experience as well as just care. Quality of life, interactions, food and dining are all priorities in a way they weren’t before.”

However, our discussions with CEOs revealed a number of challenges to ensuring customer-centricity – especially in the care homes sector. “We’re a uniquely operational business, and we’re dealing with an unsophisticated workforce,” one CEO told us. “It’s a challenge working out what steps we can take to influence behaviours, which will ultimately drive financial performance.”

In order to ensure this customer-centricity, health businesses could look into more customer-centric sectors, in particular hospitality and leisure, to drive wholesale change. Talent from these areas will be able to think holistically and disruptively, while always a retaining a relentless focus on the customer and their experience – and ensure that this trickles down through an organisation.

Additionally, leaders need to address rising costs in the healthcare sector. Our conversations with CEOs revealed that healthcare businesses across the board, but especially in care for the elderly, are reviewing their processes and products to find ways to deliver care while also cutting down costs. However, many voiced concerns that senior leaders lack the project management experience to effectively cut costs while still providing effective care. Bringing in leaders from adjacent sectors may be a solution here, especially in a post-Covid world when many executives have led or been involved in drastic cost-out programmes.

Lastly, the life insurance space has recently played host to some significant developments. AI and data has enabled providers to price health insurance to reward healthy behaviours, and given way to multiple partnerships between healthcare and businesses in the consumer-facing space. YuLife, for example, has established partnerships with companies ranging from ASOS to Calm, to reward users for healthy life choices. Indeed, Covid-19 has led to a spike for health insurance businesses, as employers double down on employee wellbeing and care.

Amid all this change, healthcare businesses should ask themselves whether they have the right combination of people in their organisation. Going forward, a talent mix from inside and outside the sector could provide the optimum mix of healthcare expertise and commercial acumen. Many businesses have already adopted this approach – and we are sure others will follow.