Something we look forward to when advising consumer companies on senior R&D appointments is the opportunity to sit down with industry leaders and discuss the pace and potential of innovation in their world. Particularly in food and drink, businesses in our consumer sector are at the forefront of tackling some of the most pressing global challenges – and hearing from senior executives about how they’re driving change is one of the many perks of my job.

Take population growth, for example. If our world continues to grow and develop as predicted, then by 2050 we’ll have to feed 9 billion people, more and more of whom will demand meat, eggs, and dairy, requiring us to grow more corn and soybeans, to feed more cattle, pigs and chickens. Working out how to keep everyone fed without overwhelming the planet is one of the most critical questions today.

In the years ahead, innovations in food technology and production methods will unlock solutions to our global challenges, and provide new and exciting avenues for commercial growth. With this in mind, the most forward-thinking companies are placing R&D at the very centre of their proposition – not only to implement new technologies but to ensure that innovation is being considered in every business decision. This is why senior presence of R&D or innovation, particularly around the C-suite, will prove increasingly critical to a consumer business’ ongoing relevance.

As food and drink businesses move into 2024, R&D and innovation is simply too big a conversation not to be a part of. There are certain areas that are growing rapidly and that have huge potential – and businesses must commit to asking the right questions.

Precision fermentation is one such area. Precision fermentation refers to a refined type of brewing – involving multiplying specific microbes – to create products like flour, proteins and fats. Creating food in this way dramatically shrinks its production footprint, using considerably less land, water and energy than traditional agriculture. Some scientists say that producing protein using precision fermentation uses 1,700 times less land than growing soy, the most efficient agricultural method. In short, this technology could have a revolutionary impact on our world as we look for sustainable solutions.

“Scientists say that producing protein using precision fermentation uses 1,700 times less land than growing soy… this technology could have a revolutionary impact on our world as we look for sustainable solutions.”

In the past few years, a handful of businesses have harnessed precision fermentation to bring exciting new products to market. A number have received regulatory approval for new protein-based products, and now partner with the likes of Nestle, Mars and others to provide sustainable dairy alternative ingredients. Most startups in this space operate a business-to-business model, supplying to restaurants and other food groups, but some have forged into the consumer space, such as Impossible Foods, which uses precision fermentation to create its burgers. This arena is ripe for disruption, and growing fast: in December, the EU committed €50m investment to support startups as they scale up the production of alternative proteins.

Another solution to agriculture challenges is cultivated meat: real meat grown in a lab. In 2023, two companies, UPSIDE FOODS, and GOOD Meat, which already sell their products in Singapore, received the first-ever regulatory approval to sell cultivated meat in the US – but no business has yet gained approval to trade in Europe. It will be interesting to see how this area develops and commercialises in the next few years – and which brands emerge as major players.

We’re also seeing businesses invest in insect protein firms. Insect protein – high-quality feedstock obtained from insects that can be used as an ingredient in animal feed – looks set to become a critical part of our global food system. At the end of last year, the meat-packing giant Tyson Foods signed a first-of-its-kind deal with insect protein group Protix to create more efficient and sustainable proteins for use in its supply chain, and outlined plans for the first at-scale insect facility in the US.

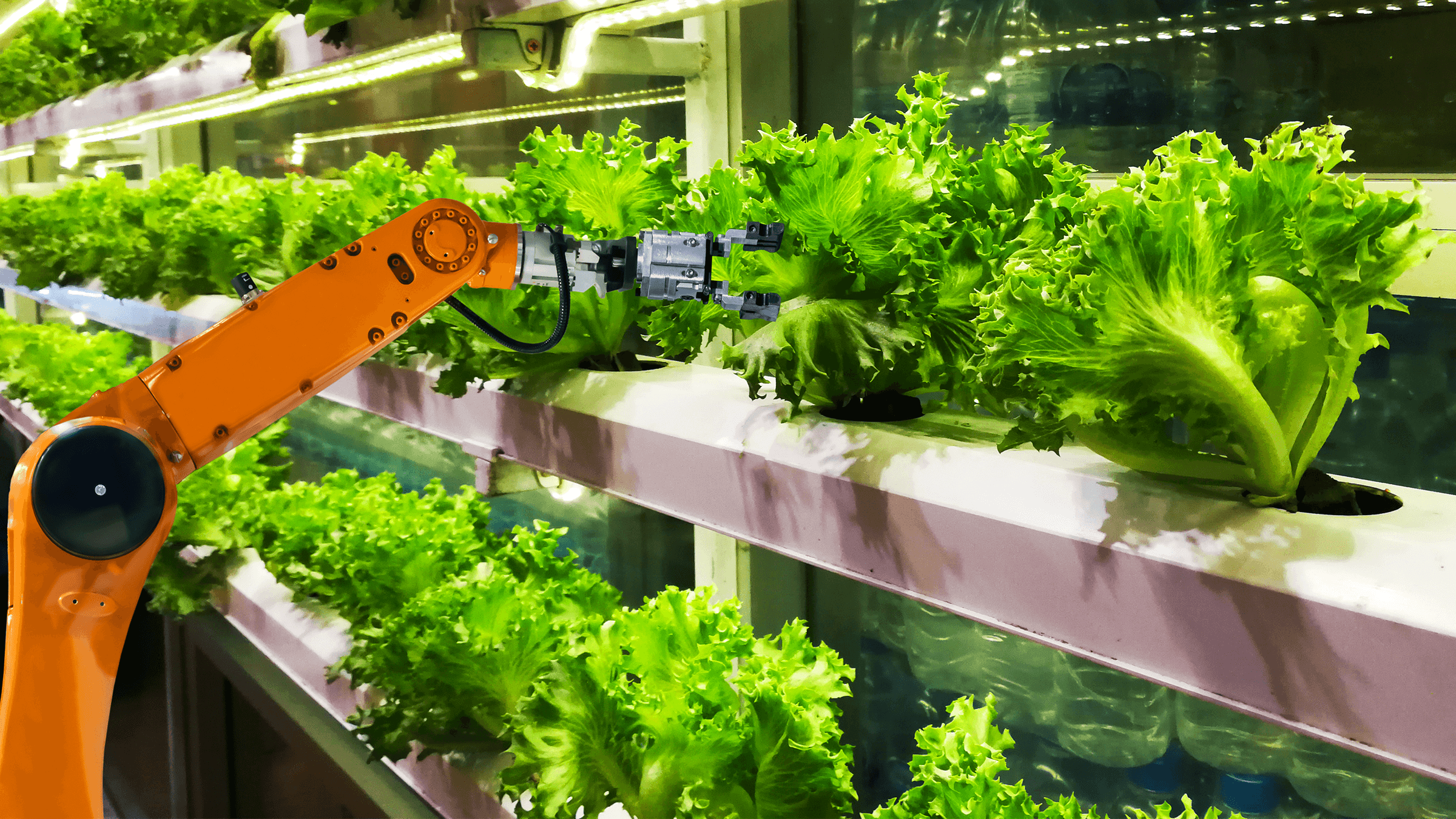

There are countless further examples of technologies which could make a permanent positive mark on our food industry: combining cultivated meat with plant-based alternatives to create a ‘hybrid meat’; high-pressure processing to extend the shelf life of food by up to ten times; gene editing; vertical farming; bio 3D printing; further developments in food packaging. The list could go on, and while most businesses will not be on the bleeding edge of these innovations, failing to take them seriously could risk falling behind. In this way, these sorts of developments should perhaps be treated in the same way as advancements in AI.

Empowering R&D leaders will be critical. Businesses should ensure that their leadership structures are designed so R&D leads can effectively ask questions, apply pressure, and offer perspectives on strategies outside of the traditional product remit. The critical C-suite R&D relationships with supply chain and marketing need to be fostered and entrenched at the heart of any progressive food, or indeed broader FMCG, business. While this has long been the case within the very largest blue-chip FMCG organisations (which often have more than ten leaders on their executive committee), it’s becoming more and more common for medium-sized multinationals to include innovation on their top bench, alongside functions like finance and commercial. This is a trend that we anticipate will only increase.

Whilst portfolio renovation has been the main focus for most FMCG food and drink business in recent years, the consumer movement to greater wellbeing looks set to drive internal innovation forward. M&A does also have a role to play, as businesses buy-in new technologies and expand their offering to meet changing consumer demand.

“Whilst portfolio renovation has been the main focus for most FMCG food and drink business in recent years, the consumer movement to greater wellbeing looks set to drive internal innovation forward.”

As an industry, there’s certainly a need for more consumer-centric innovation. This need, alongside the bigger – and so far unanswered – questions about the future of food, will propel the role of the Chief R&D Officer forward in the years ahead.

What are some of the most interesting innovations in food that you’re seeing? And who is leading the way? We’d love to hear your thoughts.