It was about this time last year that I published my signature report, Boards of the Future, with great enthusiasm and hope. The result of years of reflection and, more recently, conversations with more than a hundred NEDs, Boards of the Future contended that the role and composition of the Board must be fundamentally reimagined, without losing sight of its core oversight and governance responsibilities.

The report called for a truly diverse Board, with deep digital expertise and the ability to think holistically about a company’s place in society. Since its publication, it has been a pleasure to continue to discuss my manifesto with Chairs, non-executive directors, clients and friends of MBS, and to put my vision into practice.

Today, I am launching the second report in the Boards of the Future series – a piece of in-depth research that asks: are Boards really evolving and transforming?

This report looks in detail at all non-executive changes made to FTSE 350 Boards during 2021, including appointments, internal promotions and changes, and exits. By analysing these groups of individuals, taking into account gender, age, nationality, functional background and sector background among other areas, we have assessed the progress made in 2021, measuring changes against our five principles for the Boards of the future.

These five principles are as follows:

The Board of the future fosters diverse thinking

Combining directors whose backgrounds and experiences – both professional and personal – are varied and wide-ranging results in better conversations, more innovation and creative problem solving.

The Board of the future truly grasps digital, data and technology

Boards that incorporate genuine domain knowledge – from those who speak the language of technology and can translate it for their fellow Board members – are better equipped to challenge the business, and are clear-eyed on the risks and opportunities of digital, data and technology.

The Board of the future is grounded by veteran industry experience

Directors with deep sector experience – through multiple economic cycles – provide critical ballast, ensuring the Board doesn’t lose sight of the fundamentals, and can apply past lessons to future challenges.

The Board of the future understands a company’s place in the big picture

The Board’s ability to think broadly and beyond the commercials – on ESG, on the zeitgeist and on future trends – helps businesses secure their place by connecting with consumers, retaining relevance, and assuring a long-term future.

The Board of the future recognises its directors as individual role models

Today’s Boards are more visible than ever. Appointing directors who mirror the company’s values and reflect its customers and colleagues has the power to set the tone from the top and inspire.

—

Of course, it would be misleading to judge whether today’s Boards reflect our five principles based on 2021 appointments exclusively – but by looking at the trends in the data we can explore if Boards are being built in line with our philosophy.

As a starting point, the Board of the Future is truly diverse, bringing together NEDs with varied backgrounds and worldviews. It is critical to consider every aspect of diversity and inclusion – including gender, race and ethnicity, age, disability, LGBTQ+ and social mobility, among others – when building a Board. Reading our report therefore, you may find yourself as frustrated as I am that it focuses its analysis of diversity primarily on gender. I explain in a note at the end of this column why it was not possible to take a more holistic look in our research.*

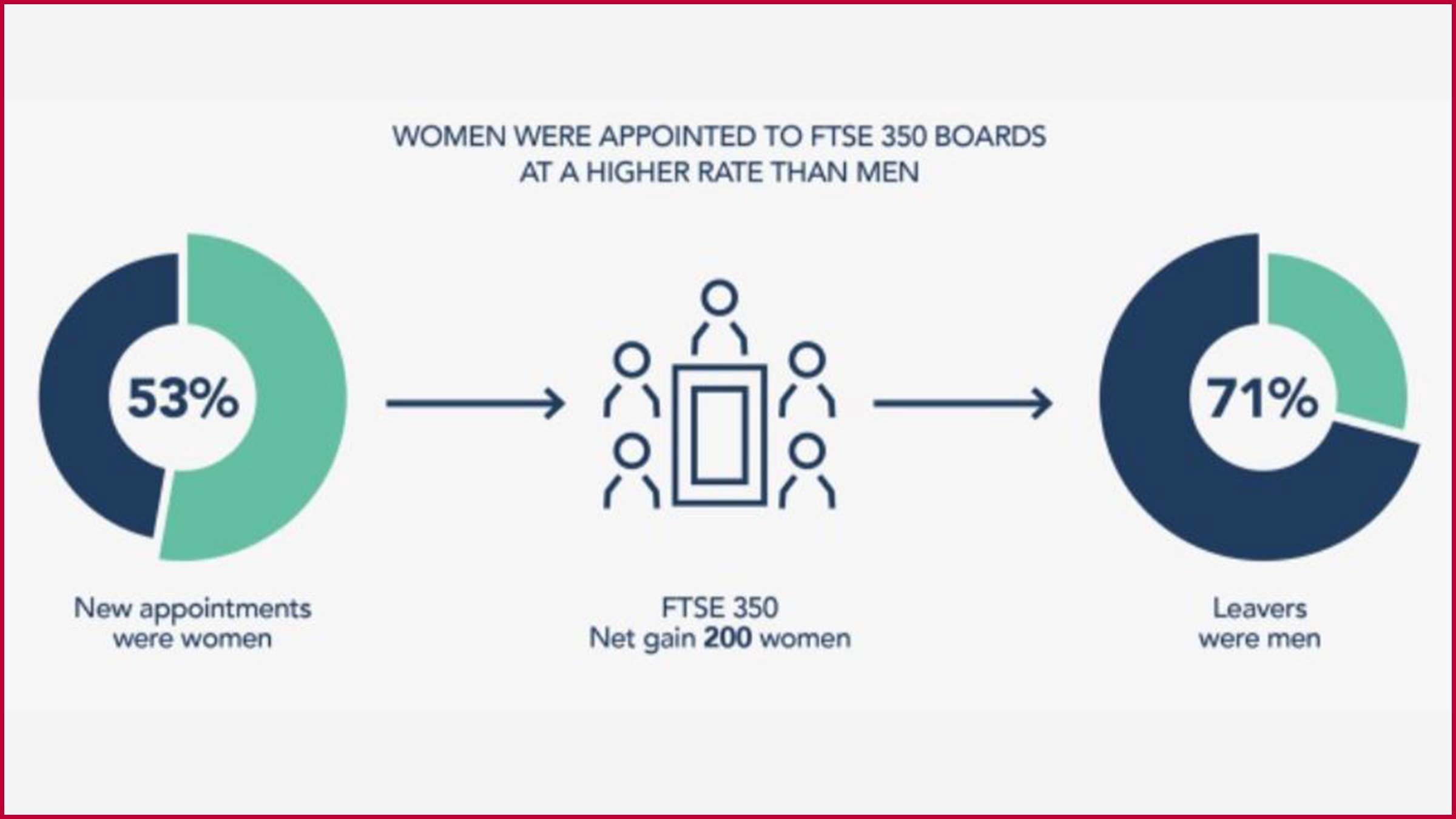

“Based on the number of non-executive directors currently sitting on Boards, if these appointment and turnover rates of 2021 were repeated in 2022, we would see a perfect 50:50 balance of men to women in one year on the FTSE 100, and two years on the FTSE 250.”

At last, 2021 gave rise to real progress on the number of women on Boards! Women made up more than half (53%) of all new Board appointments in 2021, and at the same time, men accounted for 71% of those who exited Boards. As a result, there was a net gain of 200 women on the FTSE 350. Based on the number of non-executive directors currently sitting on Boards, if these appointment and turnover rates of 2021 were repeated in 2022, we would see a perfect 50:50 balance of men to women in one year on the FTSE 100, and two years on the FTSE 250. Progress is slower in the most senior roles, however, with four out of five Chair roles going to men, and men being appointed into the SID role at double the rate of women across the FTSE 350.

Beyond gender, we know from external research that progress on ethnic diversity on Boards is far too slow. The Parker Review has found that 89 companies in the FTSE 100 have met the target of appointing at least one director of colour by 2021, and that 55% of FTSE 250 companies have already met their target of appointing one director of colour by 2024. This feels like an inexcusably low bar to reach, and speaks to the need for Chairs to refocus their efforts on diversity.

Another key principle is the need for deep digital experience on the Board. This is well understood: a recent survey from Harvard Business Review found that 80% of global directors believe digital transformation should be led at the Board level, and not relegated to IT departments. However, our research found that FTSE 350 Chairs may not be prioritising digital expertise on their Boards: only one in ten (10.3%) of all NEDs appointed to the FTSE 350 in 2021 have digital experience. Moreover, more than half (52%) of the NEDs with digital experience appointed to the FSTE 350 last year previously held a non-digital role in a digital or tech business, therefore we conclude that they may not have the necessary skills to translate digital issues of today, such as web 3.0 and beyond.

While digital experience, creative vision and outside-the-box thinking is critical to businesses, the best Boards will be grounded in veteran industry experience by NEDs who have served for decades as executives in the relevant sector. In 2021, more than a third (37%) of NEDs appointed to the FTSE 350 had veteran industry experience. The consumer-facing sector appointed proportionally fewer (20%) veteran NEDs than the rest of the Index.

“In 2021, more than a third (37%) of NEDs appointed to the FTSE 350 had veteran industry experience”

This report shows that strides have been made in some areas – such as gender – but should serve as a reminder to Chairs that much more work and strategic thinking is needed. The role of the Board is evolving in real time: since the publication of the first Boards of the Future report, we’ve seen companies move into the metaverse, respond boldly to foreign injustice and make significant commitments to sustainability. Today’s businesses must be equipped with Boards that can look beyond short-term priorities.

The question to ask ourselves is this: are the Boards of today fit to be the Boards of the future?

We need greater diversity, deeper digital expertise and for Chairs to make creative NED appointments which challenge the status quo. It is more imperative than ever that companies keep ahead, stay relevant, represent their customers and act as a shining example to colleagues and the wider community.

Change is overdue: we must keep thinking differently and make bold decisions every day.

You can read the full report here.

* An important note on diversity data:

Readers may be wondering why other areas of diversity – such as race and ethnicity, disability, LGBTQ+ and social mobility – are conspicuous only by their absence in this report. It is, after all, critical that all areas of diversity and inclusion are considered when building a Board.

This report focuses on gender because gender data is publicly available and verifiable; data on other characteristics of diversity for individual board members in the FTSE 350 in 2021 is not. While some data points are available at a whole-Board level, providing personal information on race and ethnicity or sexual orientation, for example, is not currently required of individuals who join public Boards in the UK. And nor is it a simple thing to do: requiring people to provide sensitive personal information is fraught with ethical issues.

However, data collection is an important step in driving change. Mandatory gender pay gap reporting and the visibility of gender diversity data – so far unmatched in other areas – has driven progress on the number of women on Boards. A lack of broader diversity data here means our research is incomplete, and we can’t tell the whole story of progress in 2021 – whether it’s been positive or otherwise. Nonetheless, at MBS we are absolutely clear that this does not dilute the responsibility of – or the opportunity for – Chairs to make diverse appointments on their own Boards. Indeed, we are proud that 26% of our placements and 24% of our shortlist candidates were from an ethnically diverse background, for example, across all of our non-executive Board mandates during the course of 2021.

I hope you will find our latest report of interest, and I am particularly keen to hear your thoughts — whether that be about the key findings themselves, perhaps you believe your company is building a board fit for the future, or if you have bright ideas about how we address the diversity data challenge.

Moira.benigson@thembsgroup.co.uk | @MoiraBenigson | @TheMBSGroup