To most people, the chocolate and toilet paper categories have little in common. But to Ben Black, and to the team at Verlinvest, the areas are in fact closely linked – not by their product offering, but by the opportunities they represent to fundamentally change consumer behaviour for the better.

Verlinvest is an international, family-backed investment company whose mission is to drive consumer revolutions through responsible investing, in partnership with visionary leaders who are building global impactful category-defining brands. “We’re rejecting the assumption that profit and purpose need to be at opposing ends of the same scale,” said Executive Director, Ben Black. “We’re showing that you can create big global success stories in which sustainability and ethics are revenue generators, not a cost centre.”

“We’re showing that you can create big global success stories in which sustainability and ethics are revenue generators, not a cost centre.”

Over the years, Verlinvest has successfully supported Tony’s Chocolonely as it shines a light on slavery in the cocoa supply chain, helped Oatly build a new global category in plant-based milk and change the conversation on emissions in the dairy industry, and partnered with Who Gives A Crap to offer a zero deforestation solution to toilet paper and household paper products. Last week, I had the pleasure of catching up with Ben to discuss the future of ESG, what makes a good leader of a purpose-led brand, and how Verlinvest’s portfolio companies are permanently disrupting the FMCG space.

“We look at the world a different way to many other investors,” Ben reflected when we chatted last Friday. “In particular, we’re thematic in how we identify investments, making long-term bets on changes in consumer behaviour – and the opportunity to actively drive those. We have an ‘evergreen’ model of capital which promotes longevity and means we’re not constrained by the timelines of typical financial partnerships.”

Whether it’s sustainability, supply chain ethics, or healthier alternatives, Verlinvest looks for large categories in which fundamental societal shifts are taking place, and partners with the organisations sitting at the bleeding edge of change. “We talk a lot about issue awareness,” explained Ben, “we’re looking for categories where we can drive consumer understanding of a particular negative topic, and market a better alternative.”

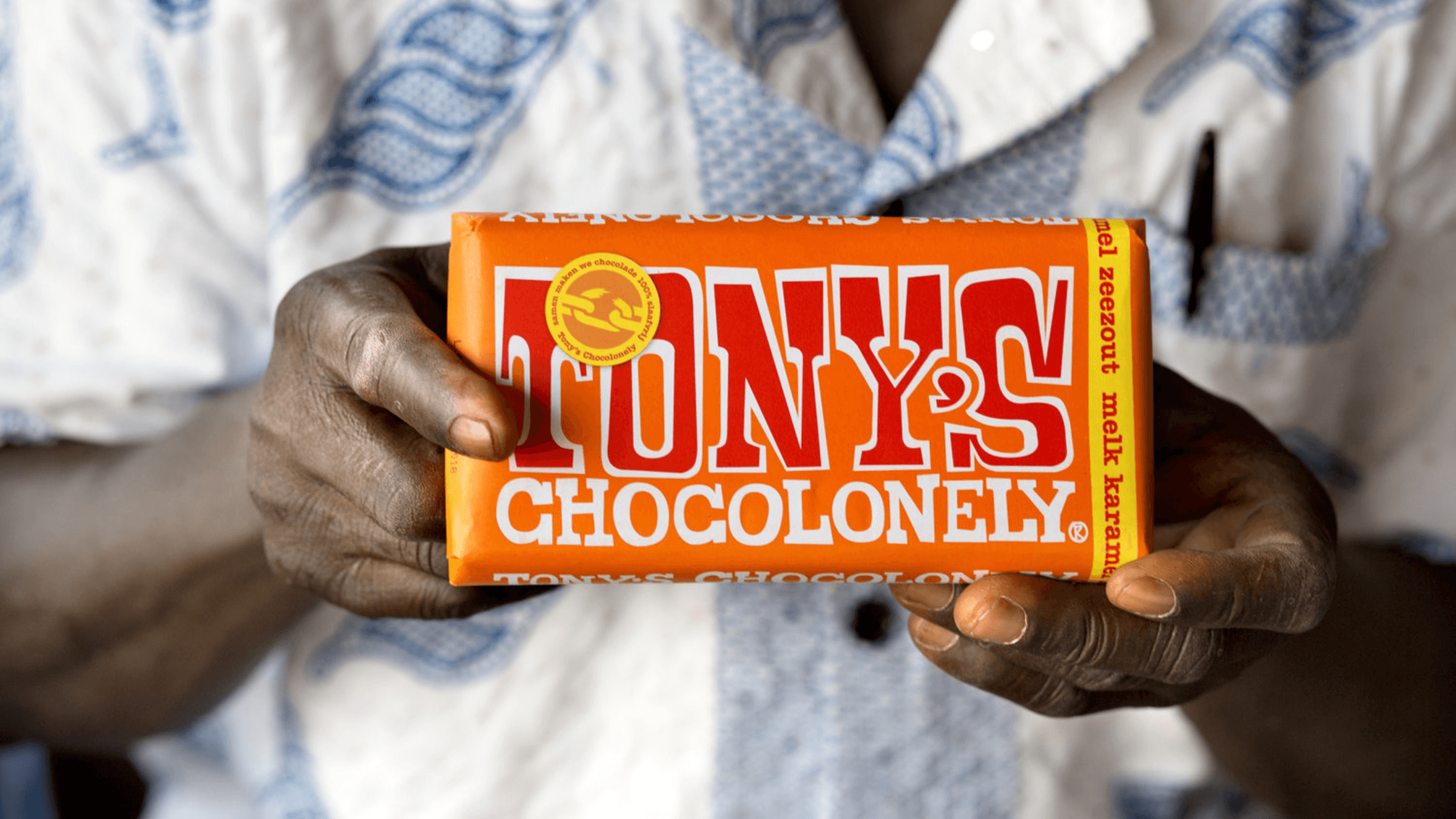

Tony’s Chocolonely is a prime example. Since launching in 2005, the chocolate brand has dedicated its efforts to educating consumers about inequality in the cocoa supply chain, and providing a product which is ethically made. “Supply chains have typically been built prioritising lowest-cost, efficiency and consistency,” said Ben, “but there’s very little public understanding about the secondary effects of this traditional model. In cocoa, the structure of the supply-chain means that profits have been channeled to a small group of western organisations at the expense of agricultural workers on the ground in West Africa, where most cocoa is grown that do not earn a living wage. It’s not that the public doesn’t care about this, it’s that they don’t know.”

Enter Tony’s, which since its inception has framed itself as an impact company that makes chocolate, rather than a chocolate company that makes impact. Awareness of poverty in the cocoa supply chain sits at the heart of all its marketing efforts, and as a result, it has built a loyal customer base of people willing to spend a little more on exploitation-free chocolate. Their impact methodology and 5 Sourcing Principles are shown to drive child labour prevalence down from industry average of c.50% to <4%, and they have opened up the supply-chain to mission-allies via Tony’s Open Chain initiative, including brands such as Ben & Jerry’s and Huel.

I asked Ben if he feels the cost-of-living crisis is threatening the success of purpose-led brands, many of which rely on customers paying a higher price for a more premium product. “There’s definitely some bifurcation,” Ben told me. “Lots of people have less money in their pocket, and there’s a growing narrative around ‘wokeism’ and greenwashing that’s making consumers question products that claim to be more sustainable. But younger consumers are still committed to choosing purpose-led brands – they just need to see true value for money.”

“Younger consumers are still committed to choosing purpose-led brands – they just need to see true value for money.”

But what is meant by value? At a time when many companies are racing to slash prices, purpose-led brands (for whom cutting prices could mean lowering ethical or environmental standards) need a different strategy.

“It’s about communication. We’re encouraging all our brands to focus on value messaging – why our products are offering good value-for-money. Our portfolio brands are providing value by giving the customer something extra, not by reducing the price-point. Tony’s Chocolonely is not the cheapest chocolate, but it’s got the lowest prevalence of child labour in their supply chain. Who Gives A Crap is not the cheapest toilet paper, but it donates 50% of its profits to building toilets and improving sanitation in developing countries. It’s also double-length, plastic-free and uses less packaging. So, it’s about education, and really informing customers on those differentiating features so they can make an informed choice.”

Guiding on marketing strategy is just one of the ways Verlinvest steers growth in its portfolio businesses. “We don’t do a lot of investments, but we spend a lot of time with the companies we back,” said Ben. “We take a partnership approach based on shared accountability, working together with the brands to launch into new markets, structure their organisation, build high-performing teams, expand their supply chains, and digitalizing processes and sales channels amongst others.”

Critical to a successful investment partnership is the right governance structure. “It sounds like a dull topic, but it’s actually a massive unlocker. Having a solid framework for governance allows us all to be held accountable, rather than putting individual leaders in the hot-seat and holding them solely responsible for the risks we need to take to succeed – taking risk is part of growth.”

Disrupter brands need best-in-class teams, and a large part of Ben’s role is identifying and bringing in leaders who can spearhead global growth. Something we’ve found at MBS is that the process of finding leaders for purpose-led brands is in some ways more straightforward than hiring into mainstream companies, as candidates can be immediately filtered by their value set. “People either get it or they don’t,” agreed Ben, “so it’s a very useful overlay. And it’s a huge competitive advantage to be able to identify and onboard the right talent for the current stage of growth quickly.”

“It’s a huge competitive advantage to be able to identify and onboard the right talent for the current stage of growth quickly.”

But there are also particular leadership characteristics needed to succeed within a purpose-first organisation. “I look for boldness, resilience, humility, and advocacy – and crucially the ability to make difficult trade-offs. Being a great leader is about making tricky decisions every day: a brand can’t lead in every area, and being a business that illustrates profit and purpose are not mutually exclusive means making compromises on where and how to win, whether it’s in packaging choices, route-to-market, logistics, emissions, or supply chain. A good leader knows that scale and purpose aren’t mutually exclusive and is willing to fully understand and articulate those trade-offs. I usually ask difficult questions around this in interviews – it’s how you sort between business leaders and people who would probably be better working in an NGO.”

The road ahead will certainly be defined by purpose, sustainability, and ESG. As of June 2023, there was $9 trillion in ESG funds, and it’s one of the only asset classes that continues to grow in an otherwise tough economic environment. But we’re also seeing the dilution and financialisation of ESG, and its shift from an identity to an audit layer. I wondered how this will impact the space and if this move is a cause for concern. “I’m not worried – all progress is good progress,” said Ben. “There are more and more proof points that good business is good for the world. When entrepreneurs raise their head above the parapet to target society’s biggest problems, that’s where true disruption and growth will take place.”