Long-time readers of our Weekend Edition will know that, each January, I write a column outlining my predictions for the year ahead. Given that “expecting the unexpected” is now the norm, it is with some trepidation that I am putting pen to paper for this year’s crystal-gazing.

To say that we are living in an interesting time for our consumer-facing sectors would be an understatement. Consumer confidence continues to wax and wane, high costs (from interest rates through to shipping) are slowing growth and eroding margins, and geopolitical instability and natural disasters continue to throw curve balls to our sectors. So with this in mind, what does the year ahead hold?

1 – The status-quo of undervalued consumer companies will be disrupted

Listed consumer businesses are currently hugely undervalued. Research by the MBS Group shows that 62% of FTSE 350 consumer businesses have a lower share price today than they did pre-Covid. In fact, somewhat incredulously, 35% of consumer businesses have a lower share price today than one month into Covid restrictions! With these very low market capitalisations, it is perhaps no surprise that private equity firms – and international businesses, with access to capital at lower interest rates – are circling UK listed consumer businesses.

The last few months of 2023 saw the first of these public to private equity deals in the UK consumer sector: in October, furniture retailer ScS was brought by an Italian peer, Poltronesofà, for £100m and The Restaurant Group was acquired by Apollo for £506m, and in December, Trive Capital inked a nearly £300m deal to take bowling operator Ten Entertainment private.

The underlying business fundamentals of consumer-facing companies remain strong, but their share prices remain depressed. The same can be said in the US: in October 2023, more than two dozen consumer stocks – including Dollar General and Target – set new 52-week lows.

With a few notable exceptions (Marks & Spencer being perhaps the best example) consumer businesses have not managed to persuade the listed markets of their true worth. Will global businesses consider alternative jurisdictions – where the value of consumer businesses is better understood – to list in? Otherwise, private equity firms undoubtedly see a value creation opportunity here, and we expect many more public to private transactions in the coming period.

2 – The sector will continue to consolidate

We saw rapid consolidation of consumer-facing industries in 2023. In retail, mid-sized high street brands like FatFace and Cath Kidston were snapped up by Next, while Frasers Group continued its play into the ecommerce space, increasing its stakes in Boohoo and ASOS and acquiring MATCHES; in hospitality, Big Table Group took on the Frankie & Bennie’s and Chiquito’s banners, and City Pub Group was absorbed into Young’s; in healthcare, Pharmacy2U acquired Lloyds Direct and Amazon took control of US-based OneMedical; in FMCG, JM Smucker bought Twinkies maker Hostess Brands for $5.6bn; and in fashion, Tapestry shrunk the number of major fashion players by acquiring Capri Holdings for $8.5bn.

As consumer businesses continue grapple with volatile trading environments and share prices remain low, we expect further consolidation as companies look to create synergies and operating efficiencies across the sector. These sorts of changes to the sector will inevitably have a lasting impact – on leadership pipelines and, ultimately, customer choice.

3 – Leadership change will accelerate

As businesses seek to transform their external IR narrative and improve share price, I predict that many long-serving and highly successful consumer CEOs will step down this year.

Something that has resonated in recent conversations with Boards is the need for fresh perspectives, energy and direction as our consumer sectors shift. Boards will be looking to a new generation of leaders who can not only step-change share price, but also accelerate areas of transformation that are possibly moving too slow under current leadership. In short, many businesses have now “survived Covid”, and it is simply time for a leadership change.

Many of these new leaders will come up through different routes. For example, in retail, we’ve seen new leaders of our biggest grocers come from Carrefour and Aldi – new sources of talent for UK grocery. More generally, as a grasp on AI becomes central to business success, will we see the first wave of CEOs with more digital, technology and AI backgrounds?

4 – Generative AI will have a game-changing impact on our world

The impact of large language models like ChatGPT will no doubt define the year ahead. For consumer-facing businesses, 2024 will be the year that many adopt and integrate AI tools to help drive efficiency and streamline processes. Marketing and back-office functions will be obvious starting points, but by the end of the year it is hard to see which elements of consumer facing businesses won’t be impacted.

In the coming period, all C-suite executives should be seeking to educate themselves on these emerging AI technologies, and their potential impact on their businesses. Leaders should be asking themselves five questions on AI:

1/ How do I educate myself about AI?

2/ How will AI reshape my sector?

3/ Which parts of my business can benefit from AI?

4/ How do I acquire or integrate the right AI technology into my business?

5/ Do I have the right governance structure for AI in my business?

5 – We’ll see more cross-sector thinking

Mattel won big from last summer’s Barbie movie. The Mattel/Warner Bros crossover – which became the studio’s highest-grossing film – is a prime example of the benefits of franchising well-loved brands to allow customers to experience them in a new way.

While there are more films in the pipeline for the toymaker (including live-action films centering Polly Pocket and the card-game Uno), there is so much room for format creativity and innovation here, which I’m sure we’ll see into 2024. Netflix, for example, has announced plans for a string of permanent physical stores – dubbed Netflix House – where fans can immerse themselves in their favourite TV content by shopping for merchandise, eating themed food and trying out unique experiences. I’ll be interested to see which other brands find new routes to market, and new customers, through creative cross-sector partnerships.

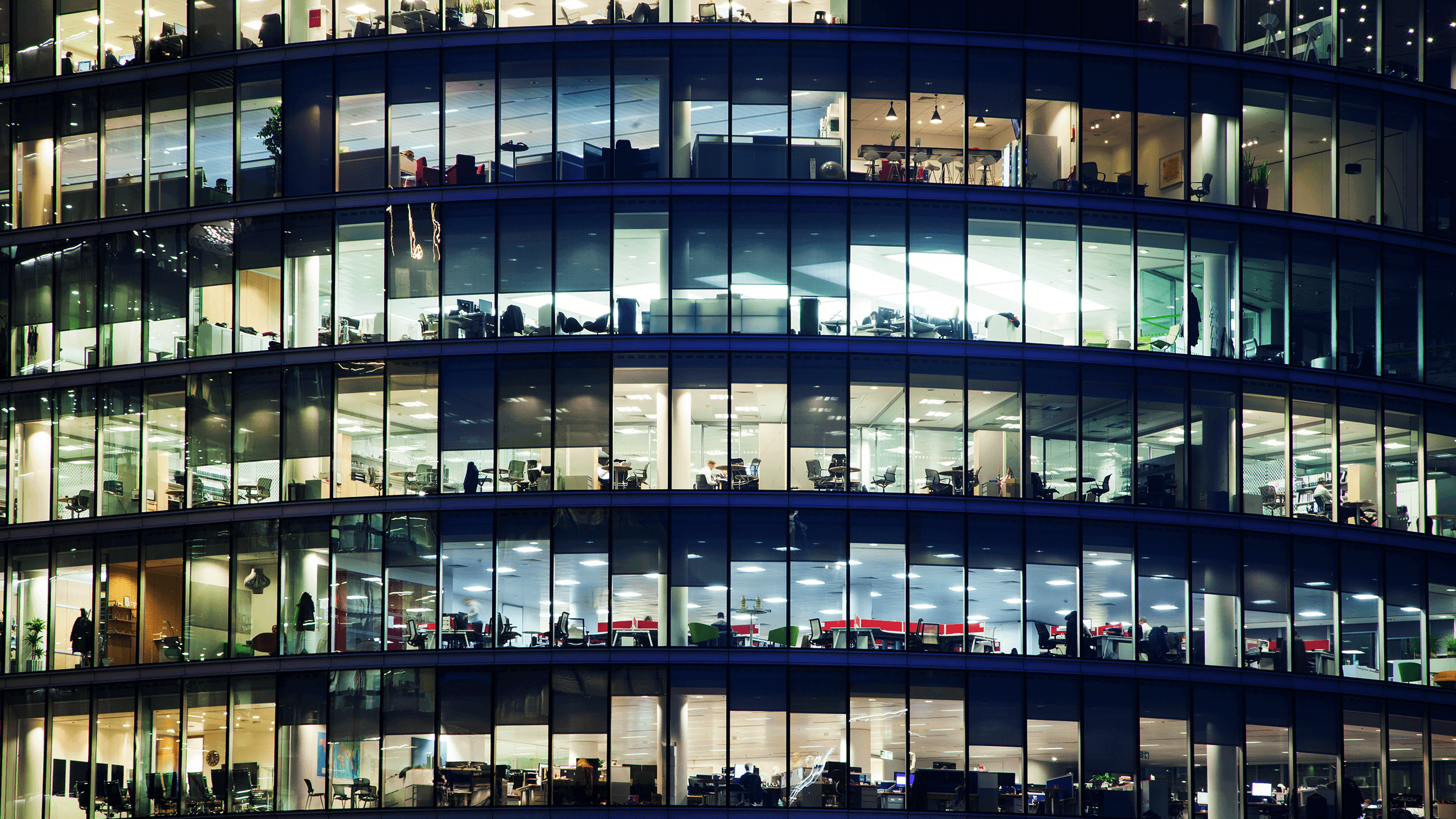

6 – We’ll return to offices – and workplace cultures will become more human-centric

I have no doubt that businesses across our sectors will be asking employees to return to the office on a more consistent basis in 2024. Almost all CEOs I speak with are clear that being physically together enables more creative and collaborative thinking, and allows for better professional development (particularly for more junior employees). For businesses in our sector, in-person working is once again becoming seen as critical to nurturing a performance culture.

However, today’s teams have different expectations of their employers, and notions of work-life balance have shifted permanently in the wake of the pandemic. This year, I predict we’ll see more and more businesses invest in diversity, mental health, wellbeing, menopause support, parental leave, hybrid working, flexibility and professional and personal development. Unless organisations put their people at the centre of decision making, they’ll lose out to more forward-thinking competitors – on talent, creativity, and eventually, customers.

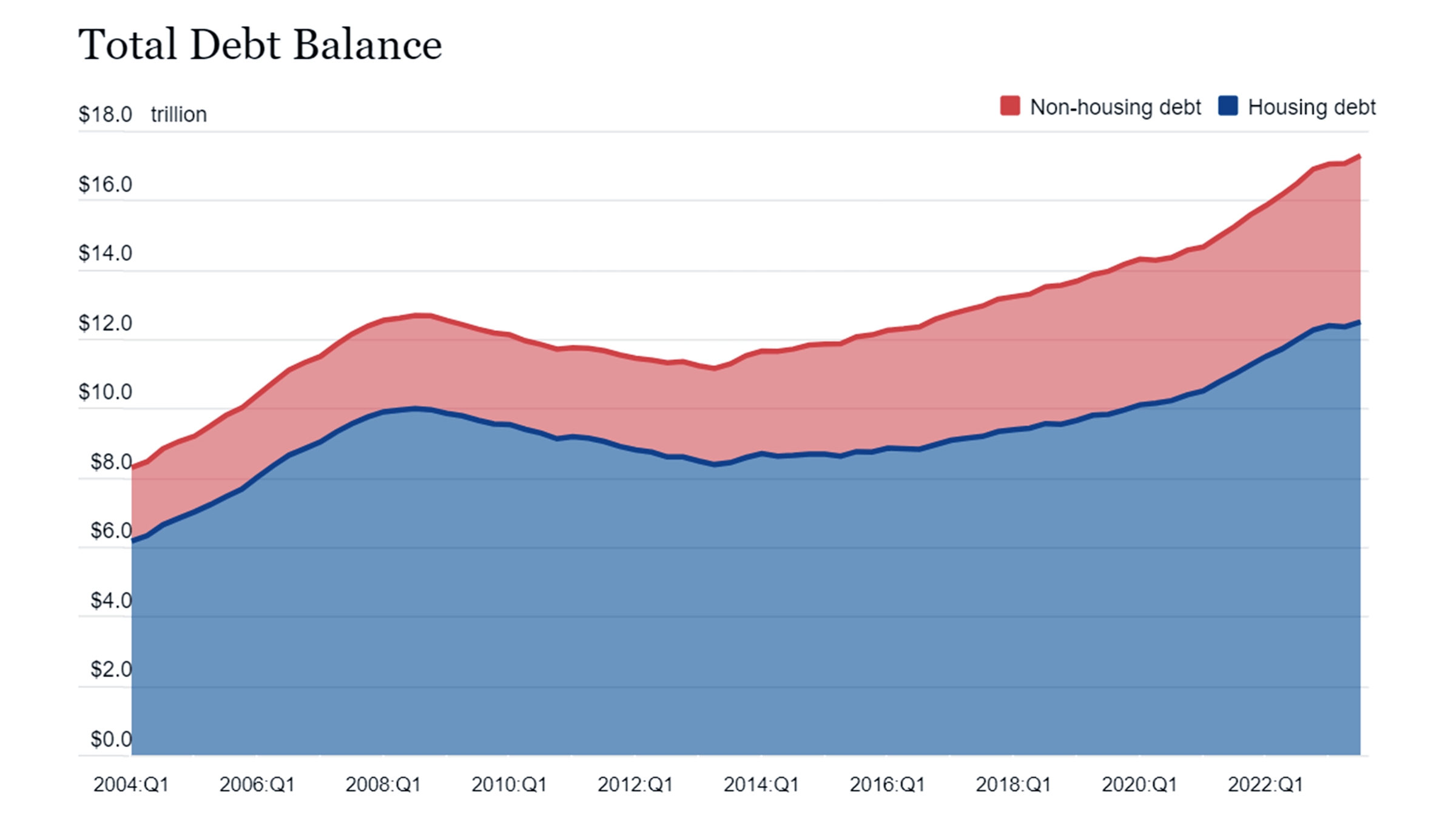

7 – Consumer spending will remain curbed

Inflation and rising costs will continue to weigh down consumer confidence into 2024. This will be felt particularly keenly in the UK, which is predicted to have the slowest rate of economic growth in the G7. Indeed, research from the Resolution Foundation predicts that typical working-age household incomes in the UK are on course to be 4% lower in 2024-25 than they were in 2019-20, in part because of the higher mortgage costs from rising interest rates that have yet to be passed onto households. In the US, Americans had racked up nearly $5 trillion in non-housing related debt by the end of September 2023, with almost a third of consumers saying they max out their credit card every month.

In the UK, this was effect can already be seen in the December retail footfall data released by the BRC yesterday – footfall decreased by 5.0% in December vs last year, and was down by -0.7% in November. Winners will probably be found at both ends of the market: discounters, as consumers seek havens in best-value products, and luxury and premium brands as consumers continue to “save” for special purchases.

8 – Businesses will become relentlessly focused on their core proposition

To face the many challenges 2024 will no doubt present, CEOs are re-thinking their strategy to re-focus on a core offering. Rather than driving expansion, broadening out services or tapping into new opportunities, businesses will nurture and invest in their “hero” proposition. Leaders shouldn’t be afraid to shrink their business and ruthlessly prune their portfolio to drive growth of the core.

In a capital constrained world, investment should be focused on what really matters – and where their true competitive advantage sits. Expect more transactions like Unilever’s spin-out in December of its non-core beauty brands unit Elida (which includes the Impulse and Q-tips labels) to PE firm Yellow Wood.

As part of this, I’m sure we’ll see more ‘right-sizing’ announcements as companies streamline operations, and also the emergence of new, creative ways to become leaner organisations.

9 – Health and wellbeing will move closer together

The notoriously change-resistant healthcare sector will continue to follow the consumer-sectors by becoming more patient-centric, fueled by data and digitalisation and data. A swathe of newly appointed, more patient-centric leaders – with different skills and perspectives – will align themselves better with patient demand to fuel transformations of legacy healthcare businesses.

Likewise, the success of scaling businesses like Zoe (which provides personalised nutrition advice based on at-home testing) demonstrates the demand from consumers for products and services that see Health as just that: Health, rather than the alleviation of illness or disease.

Models like Nuffield Health – which has long pioneered bringing together services that have traditionally been labelled “fitness (in gyms) with “healthcare” (through rehab services and physiotherapy) will become more common place. Meanwhile an increased interest in women’s health will also drive the development of more holistic services like those at Newsom Health, which provides treatment, care and information around perimenopause and menopause.

Healthcare businesses which become more oriented around “health” and wellness are definitely tapping into unmet consumer demand – and will become clear winners in the coming period.

10 – Purpose will prevail

The drive for businesses to become more purpose-led will certainly continue. Investors will find creative ways to hold companies to account, and consumers will continue to vote with their feet when it comes to the stances brands take on global and social issues. But at the same time, we can expect the dilution and financialisation of ESG, which may take on the role of an audit layer, rather than an identity. As of June 2023, there was $9tr in ESG funds, and it’s one of the only asset classes that continues to grow in an otherwise tough economic environment. In 2024, to be truly purpose-led will mean making bold moves.

Even if none of my other predictions for this year come to pass, there are two things I’m unequivocal about: the strength and creativity of the consumer-facing sector, and the resilience of its leaders. I am certainly excited for this year, and look forward to seeing how our industries evolve within this rapidly changing, and ever-challenging, landscape.