Covid-19 has caused never-before-seen disruption for the hundreds of private equity funds which invest in consumer industries across Europe. During this time, funds have been required to provide huge packages of support, both financial and practical, to ensure the survival of their existing assets, while simultaneously thinking strategically about maximising opportunities in deploying capital in the near future.

Over the past three months, The MBS Group has conducted interviews with more than 100 partners and investment directors of private equity funds, as well as Chairs and CEOs of PE-backed businesses. Based on these discussions, we are pleased to present this report, providing a detailed snapshot of how private equity has been impacted by Covid-19, and how leadership priorities have shifted in light of the pandemic.

With a few notable exceptions, our report confirmed that most consumer businesses backed by private equity funds across Europe have faced challenges at an unprecedented scale and severity. Despite this, our conversations with consumer funds were overwhelmingly positive in nature and showed that:

• PE funds have an appetite to invest in the broad consumer sectors going forward, and predict high levels of innovation in the future;

• Investment Directors and Chairs have been pleased with the performance of their executive teams through the crisis; and

• CEOs feel that Covid-19 has deepened the relationship between themselves, their colleagues and their funds.

Appetite for investment

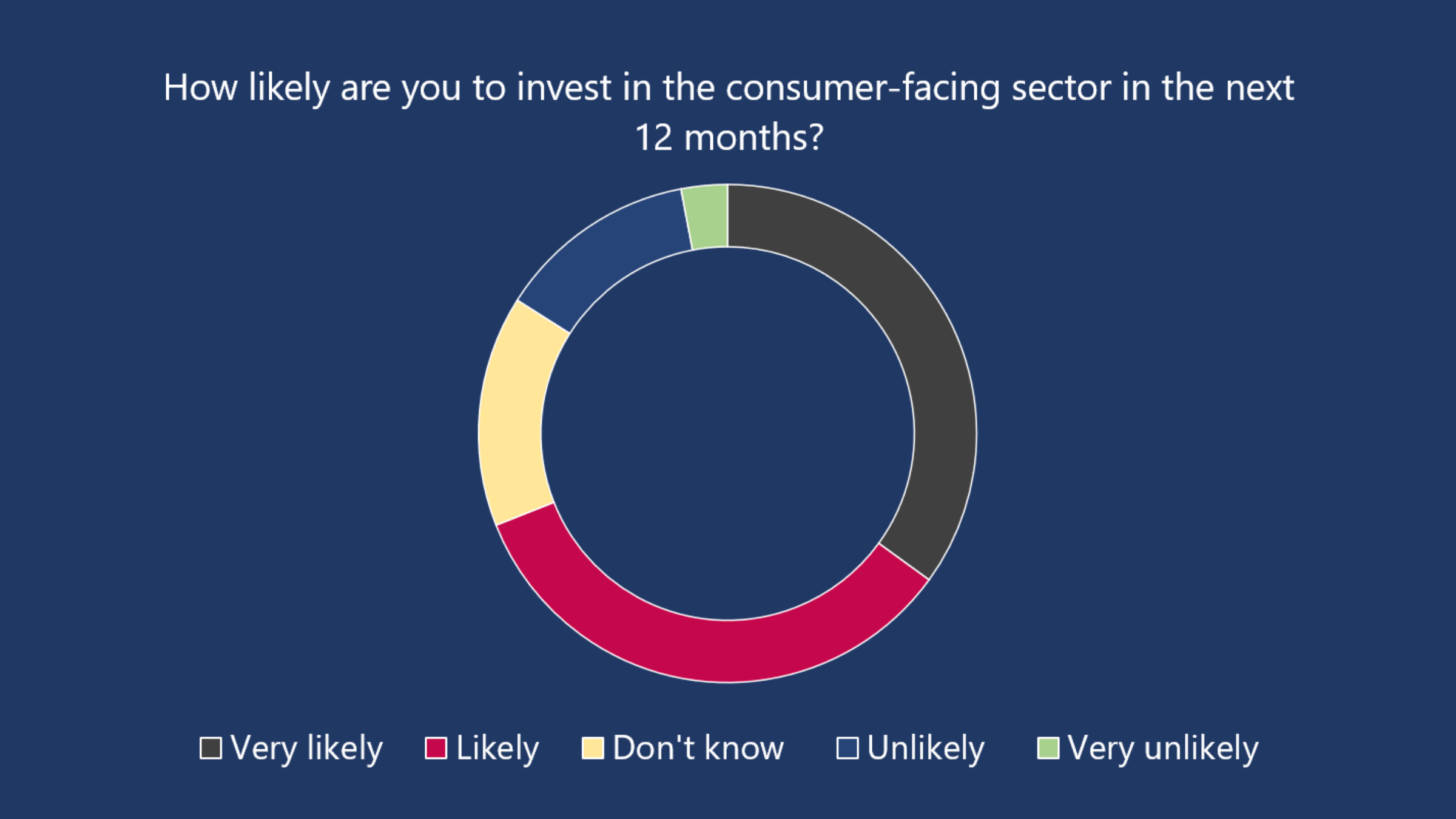

We found that a majority of private equity houses saw opportunity amid the disruption of Covid-19. 69% of funds said they were either ‘very likely’ or ‘likely’ to make an investment in the consumer-facing sector in the next 12 months, with only 3% of funds saying they were ‘very unlikely’ to make an investment.

Broadly speaking, in creating future investment cases, Covid-19 has served to accelerate existing underlying consumer trends: exacerbating pre-Covid-19 challenges in the casual dining sector, driving digital innovation and widening the gap between traditional and forward-thinking retailers, for example. Private equity funds look set to invest with these trends in mind, gearing their investments towards companies with a solid business model, a strong brand and a clear purpose. Indeed, our research found that very few funds are interested in turnaround projects and investing in distressed investments, but instead are looking for companies with a strong EBITDA pre-crisis. As one fund put it: “we will not compromise on quality.”

The report provides a full analysis of private equity interest in the consumer sector, exploring sub-sectors, geographies and the new considerations funds will make before investing. One point that resonated strongly throughout our conversations was the focus on digital. The same viewpoint is shared across the industry, with funds identifying “an innovative and established digital presence” and an omnichannel approach as necessities for potential investee businesses regardless of sub-sector. Other priority areas for investment include asset-heavy sectors (for instance, pubs and hotels), food and drink, beauty, personal care and homewares. Moreover, funds told us that they were increasingly interested in debt investments, rather than equity.

Lessons from Covid-19: Leadership needs in a crisis

“My experience,” one fund told us, “is that a crisis creates and defines leadership.” This sentiment underpins many of our findings in the report, especially around new roles that have come to the fore and the shifting relationships between funds and their portfolio businesses during Covid-19.

Throughout our discussions, almost every respondent told us that Covid-19 had brought businesses closer together, and increased the engagement between funds and their investee companies.

One Chair of a PE-backed business illustrated this: “I have not come across one fund in the consumer sector that hasn’t tried to help where they can. Especially with businesses that are having to refinance, I’ve seen funds leveraging their banking relationship and speaking to the banks on behalf of the businesses. They’ve also been supportive in terms of sharing best practice.” Across the sector, we have seen funds balancing the provision of practical support, such as renegotiating covenants, sharing data and injecting capital, with general advice – making connections between portfolio Chairs, CEOs, CFOs and HRDS, through to providing emotional support and encouragement to their portfolio businesses.

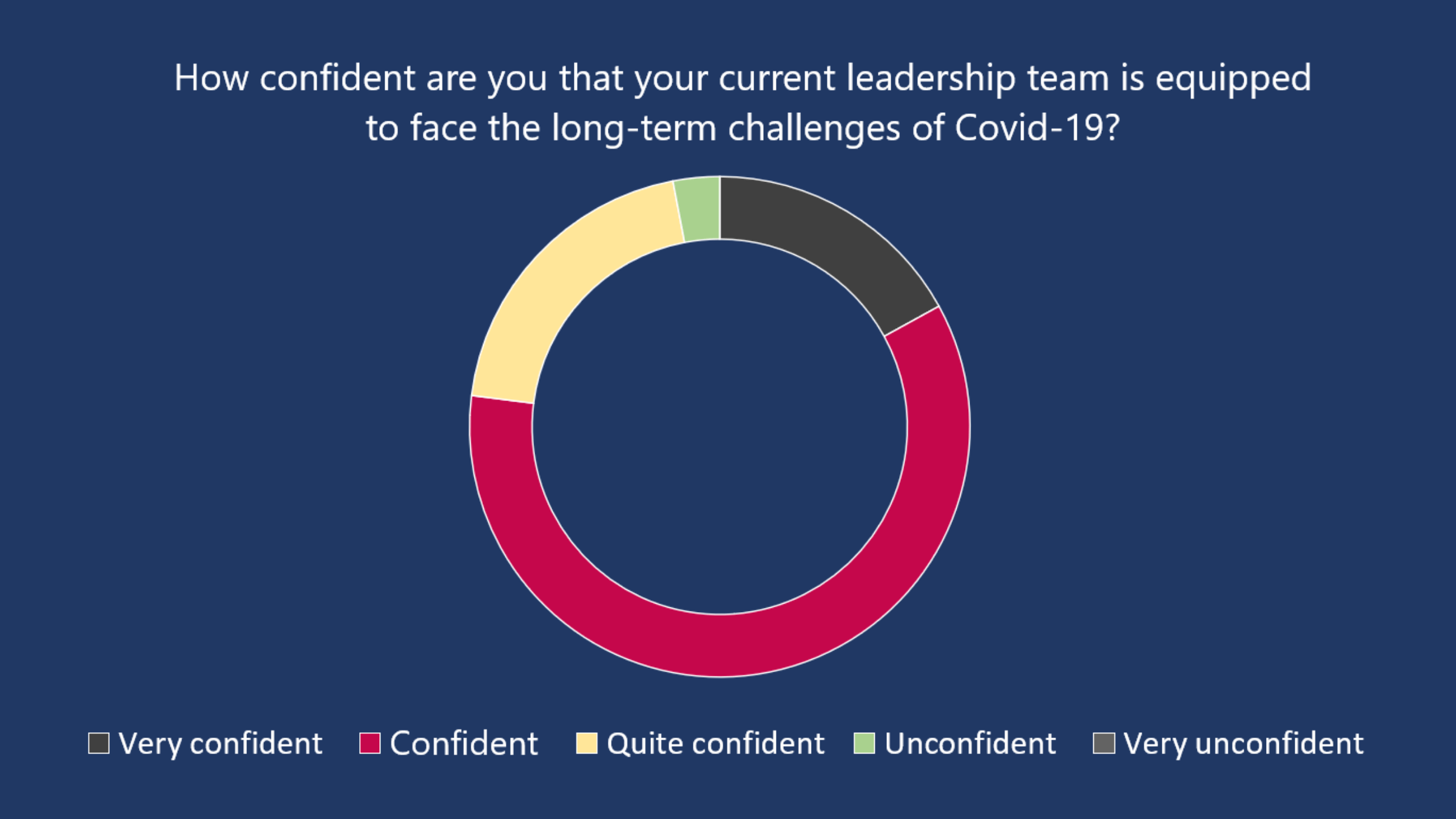

Alongside an analysis of fund leadership, the report takes a closer look at management during Covid-19, and deep-dives into the key roles during a crisis, including the CEO, CFO, HRD and Chair. Indeed, most funds and Chairs noted that their management teams had risen to the challenge of the crisis, with 76% of funds telling us they were either ‘very confident’ or ‘confident’ in their executives. In particular, but with some exceptions, it was felt that founder CEOs, who know every aspect of their business and customer intimately, and more seasoned CFO’s (often those who led businesses through the last global financial crisis) had performed particularly well over the first few months of the crisis.

Looking ahead: leadership needs in our new normal

Covid-19 has disrupted the talent landscape, and brought an entirely new set of leadership priorities to the fore. Looking ahead, businesses – and their funds – must think carefully about whether their teams are equipped with the right set of skills to achieve the full-scale transformation required in our new normal. One fund explained: “I think there is fair argument to say that we will look at a different skillset depending on the business and its recovery strategy. Some of the seats around that board table may need to be different to deliver the new strategy. So yes, we are anticipating change – how deep and broad that will be, I’m not sure yet.”

The report looks at the upcoming phases of Covid-19 – trading in the new normal, transformation and envisioning the future – in order to examine what leadership traits and skills will be needed. Our research also covers topics such as diversity, and the issue of remuneration and incentivisation – both of which will need focus in order to ensure that private equity backed companies are able to attract and retain the best talent going forward.

The ‘new normal’ presents many challenges and opportunities for private equity funds with a consumer focus. As we move out of these initial ‘survival’ phases, funds will need to continue to provide significant support, direction and encouragement to their investee companies as consumer businesses resume or accelerate trading. Concurrently, they will need to evaluate new investment opportunities and vehicles – including in adjacent sectors and territories, possibly outside of their usual core comfort zone – to capitalise on future investment opportunities.

It is clear from our report, which you can find in full here, that the demand for consumer assets at the right price remains robust – and we expect significant activity as we move towards the end of 2020 and early 2021.

We hope that our report provides an informative overview of the outlook, challenges and opportunities for private equity funds with a consumer focus. Your feedback and insights on the report would of course be much appreciated.

Elliott.goldstein@thembsgroup.co.uk | @TheMBSGroup