Private members’ clubs have been a feature of major cities for many centuries. In London, the first gentleman’s club – White’s – can be traced back more than 300 years. In New York, The Union Club became Manhattan’s first private club in 1836. And in Sydney, The Australian Club has been active since 1878, when English settlers founded the organisation as a place to do business.

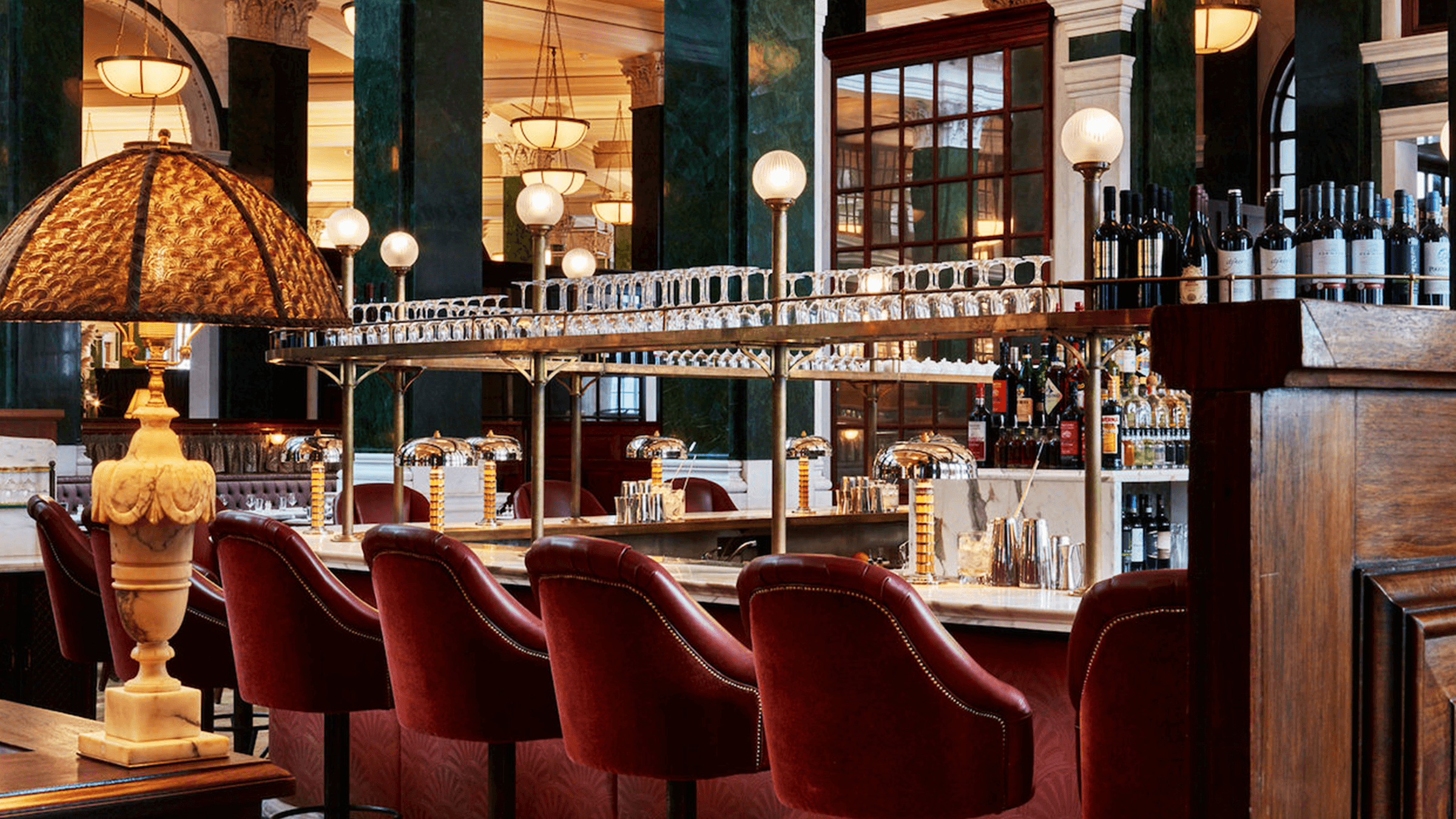

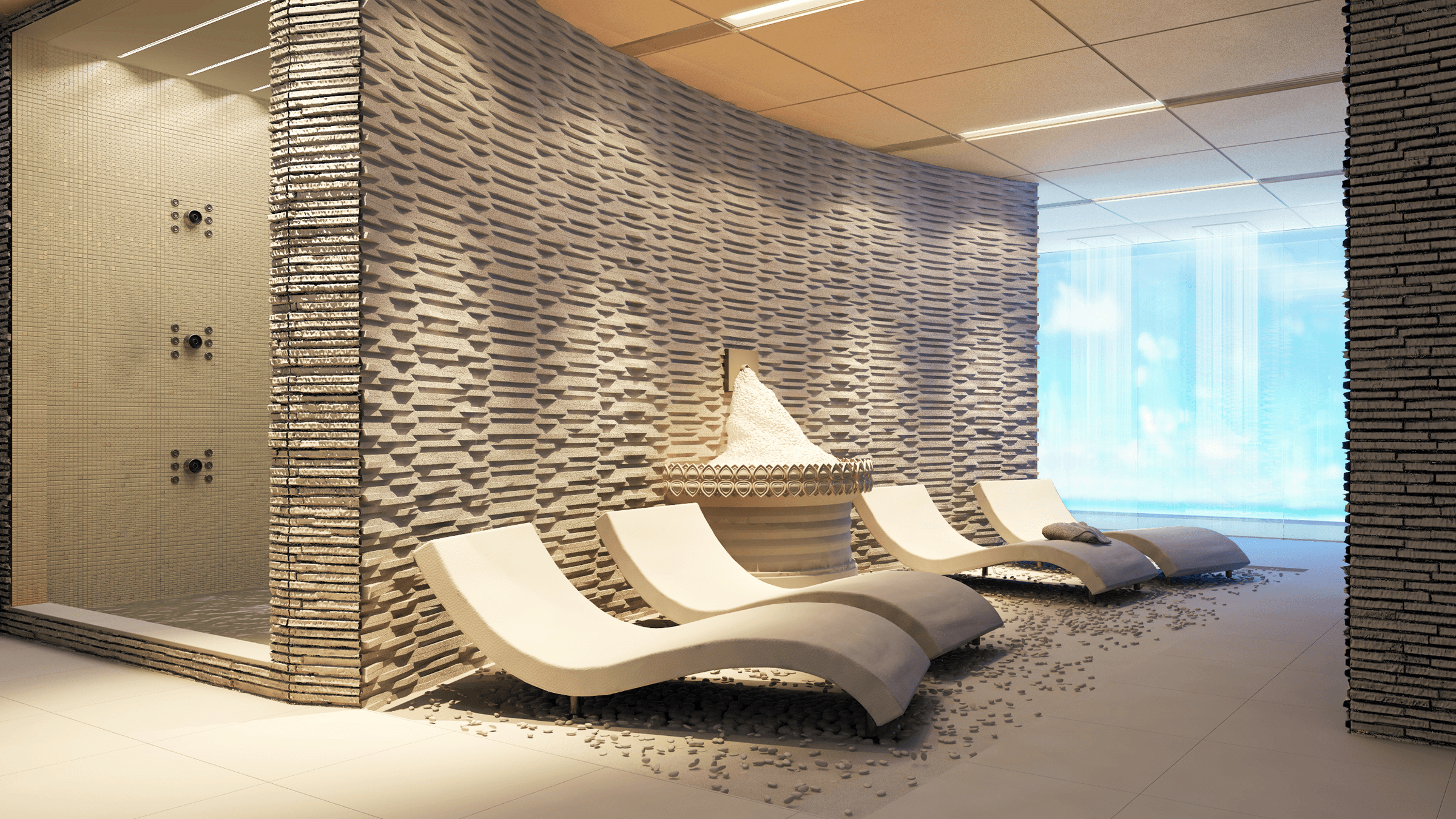

Fast forward a few hundred years, and private members’ clubs are witnessing a resurgence. While the experience of visiting a private members’ club has evolved considerably since their inception – stuffy interiors have been updated, smoking rooms have been replaced with gyms and spas, and it’s now more common to find women-only clubs than those open exclusively to men – the core offering hasn’t changed much since the nineteenth century. Today’s clubs still offer a ‘third space’ for members to work and socialise, as well as promising professional and social connections.

Since the 2010s, we’ve seen a steady flow of exciting new businesses emerge in cities around the world, offering exclusive access to premium locations, best-in-class hospitality, and likeminded communities of members. Concepts range from the ultra-exclusive (like New York’s Casa Cruz, whose 99 members pay $250,000 in membership fees) to the purpose-led (like The Conduit in London, which limits its membership to professionals creating a fair and sustainable future). Many clubs revolve around specific concepts (wine, tech, watches, cigars), and others operate entirely online. Today, the industry is booming: by 2027, the market is expected to reach $25.8bn, representing an annual growth rate of 11.2%.

It’s impossible to discuss private members’ clubs without mentioning Soho House. Aimed at those in the creative industries, Soho House can be credited with helping to reinvent how members’ clubs were perceived. Originally founded in 1995, the club now has well over 100,000 members, and properties all over the world. The success of Soho House has provided a blue-print for the newer entrants to the market.

It’s also impossible to separate the more recent revival of members’ clubs from the pandemic. As opportunities for human contact became few and far between, clubs promised something of a social refuge, even as their physical spaces were forced to close. And now, in an era of flexible working, members’ clubs fulfil the need for a creative, hybrid space to do business.

“In an era of flexible working, members’ clubs fulfil the need for a creative, hybrid space to do business.”

It’s been interesting to watch the market grow. 67 Pall Mall, for example, opened its first club in 2015 and now has three locations globally, with plans to double its estate this year. Founded by and catered to wine lovers, its central premise is its world-class wine list, which it sells to members “on the basis of a small cash mark-up, rather than at a multiple of the cost price.” Then there’s Cloud Twelve, a Notting Hill wellness and lifestyle club that’s designed with families in mind. Children as young as three can take classes in art, science, and botany, while adults visit the spa or take a yoga class.

Clubs for women in business have also surged in popularity. Allbright, for example, aims to “enable ambition in all its forms,” and is open to women at every stage of their career. The club operates a London townhouse (with two restaurants, a bar, a workspace and a hair salon), as well as frequent events and workshops. Chief, meanwhile, is targeted exclusively at senior-level women: according to its website, more than three-quarters of Fortune 100 companies have an executive that’s a member.

While most clubs are defined by their physical space, some of the most innovative entrants to this arena operate digitally. For an annual fee of £2,200, members of ‘digital concierge’ Velocity Black get priority access to events, discounts on luxury goods, and the first pick of once-in-a-lifetime experiences. The app-based business is backed by $28m in VC funding, and was acquired in June by credit card giant Capital One. Elsewhere, Lowicks, The Noticeboard, and Radio H-P have launched digital communities powered by mutual connections, where members can advertise holiday properties, buy and sell items, and promote their projects.

The popularity of members’ clubs will no doubt drive the hospitality sector forwards. For real estate developers, there are opportunities to open clubs in underserved areas, to repurpose unused or unprofitable commercial space, or to partner with existing private clubs to expand into new markets.

“There are opportunities to open clubs in underserved areas, to repurpose unused or unprofitable commercial space, or to partner with existing private clubs to expand into new markets.”

For established luxury and lifestyle brands, moving into the private club space allows them to engage customers in a new way. We’re already seeing this happen: at the end of last year, Harrods opened its first private members’ club, in Shanghai. The club, called the Residence, is located inside Shanghai’s historic Cha House where Harrods already operates a tea-room and bar. For an annual minimum fee of £16,500, Residence members can eat at Gordon Ramsay’s first restaurant in China and fly in Harrods’ own private jets.

While the market is booming, success in this space is not without its challenges. Extortionate rents in capital cities have forced some brands to shut down their properties, and others have had to lower their membership prices amid the cost-of-living crisis. And as the industry becomes more and more saturated, clubs must find a way to cut through the noise without risking their all-important exclusivity.

I will be keen to see how the market evolves. Members’ clubs present exciting opportunities for businesses from right across the consumer-facing sector, and we will no doubt see continued collaboration between like-minded brands in the years ahead. And as companies consider their growth strategies in a challenging market, I’ll be watching how clubs grow their membership without diluting their brand. What do you predict for the future of the industry? I’d love to hear from you.