Just over a year ago, in partnership with the BRC, we set out to hold up a mirror to UK retail and measure the true status of diversity and inclusion in the sector. This week, we are delighted to share the second edition of our research, “Tracking progress on D&I in UK retail”, measuring progress, or lack thereof, changing the D&I dial over the last 12 months.

And what a year it’s been for retail. “Business as usual” has been overshadowed by Covid waves, a war in Ukraine, supply chain blockages, labour shortages and a cost-of-living crisis – to name just a few of the challenges the sector has faced. Against this incredibly challenging landscape, and with a seriously testing outlook ahead of us, have businesses remained focused on D&I? Are inclusion strategies making any impact? And do leadership teams better reflect the communities they serve?

As before, this report draws on MBS research – which encompasses data captured from the industry’s leading businesses through conversations with Chairs, CEOs and HR Directors, and analysis of over 200 retailers’ leadership teams. Additionally, for the first time, we have also been able to take a look at data provided by 32 signatories to the BRC D&I Charter on the makeup of the entire workforce of these companies. Our research looks in depth at gender, race and ethnicity, LGBTQ+, disability, social mobility and age, exploring the diversity of our industry’s leadership teams and the extent to which D&I is being prioritised.

The evidence we outline in this report tells a story in two halves.

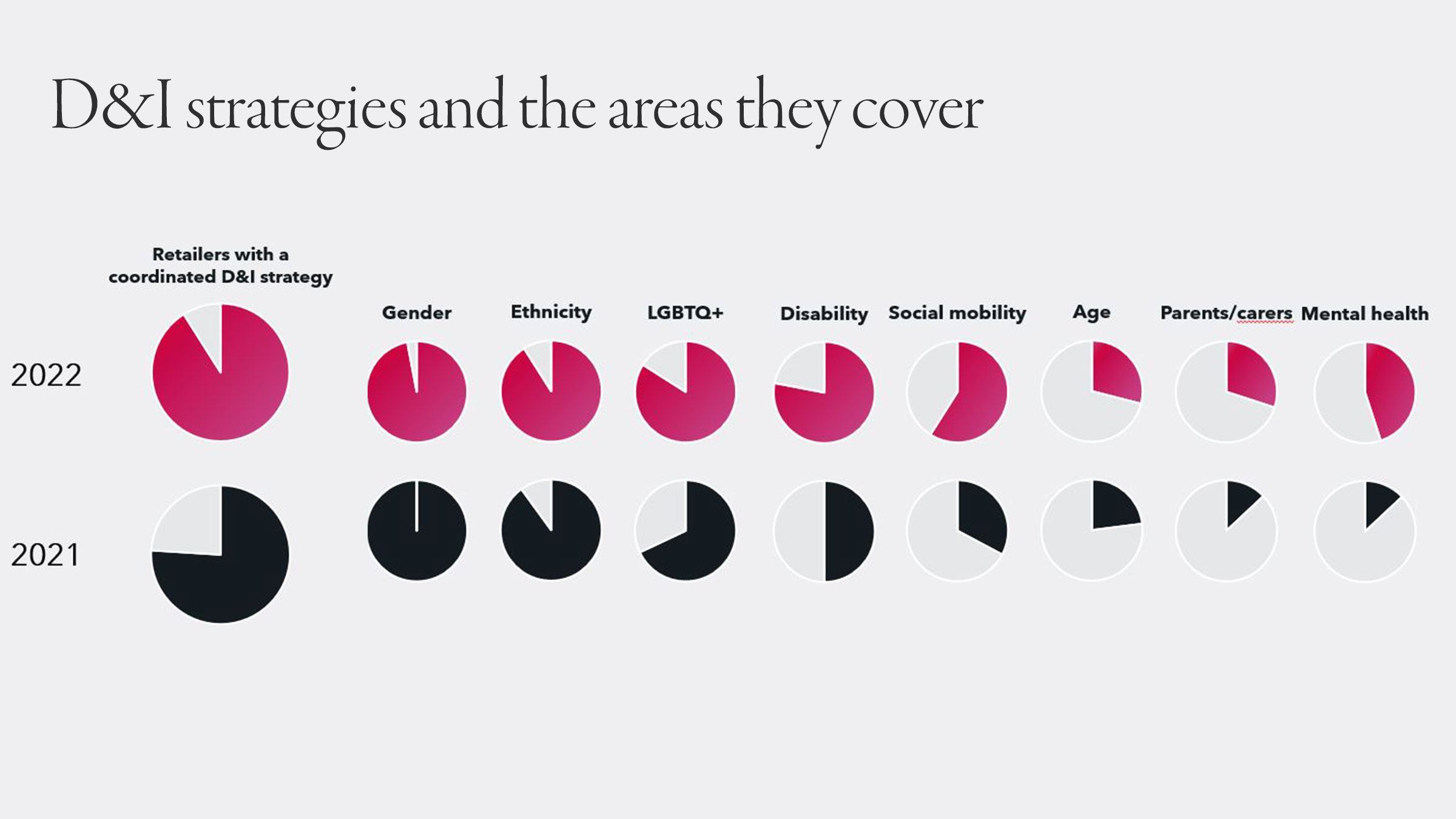

On the one hand, positively, retailers have made real progress on launching and rolling out D&I strategies. Nearly all (91%) retailers now have a coordinated D&I strategy in place, compared with 76% last year, and three-quarters of businesses say that the D&I agenda is owned by the CEO, compared to only half in 2021. Those strategies are also more comprehensive than ever, with many more including efforts to increase social mobility and disability and LGBTQ+ inclusion.

The collection of data itself – always a barrier to progress – has also improved significantly since last year. Today, a large majority (78%) of businesses collect D&I data on their business and many are expanding data collection schemes to ingest information on employee mental health, sexual orientation, socioeconomic background and disability status.

Further proof of an increase in the sector’s intent to move the dial is evident in the number of retailers who have now signed up to the BRC’s D&I Charter. Today, 76 companies (pictured below) have agreed to the set of 6 commitments – almost double the number when the Charter launched last year, and growing all the time.

Looking at the leadership data, we have seen a modest increase in female representation at the board and executive committee levels – but still well, well beneath gender parity. Meanwhile, ethnic minority representation has increased significantly at all three of the most senior layers of leadership. More companies were able to identify an openly LGBTQ+ or disabled colleague amongst their leadership teams this year too.

On the other hand, there are several reasons to think we have to be able to do better as a sector.

Despite some progress on gender diversity, for me the data presents two red flags that we need to address as an industry. Firstly, there continues to be a severe shortage of women in the most senior strategic leadership levels of an organisation: Chair, CEO and CFO – where roughly just 8%, 10% and 10% of leaders are female respectively. Indeed, the vast, vast majority (over 60%) of retail businesses don’t have a single woman in any of those three roles: in other words, there are no visible female role models in these top 3 roles in their organisation.

Secondly, as the table above shows, the percentage of women at the direct reports (into the executive committee) level actually fell back this year. Given this is the most populous leadership level – and makes up the pipeline for future ExCo members – we will be watching this data point very carefully in the year ahead to assess whether it is a blip, or a more troubling trend.

Additionally, progress on improving ethnic diversity has not been uniform. Our research shows that whilst on average across the sector there has been huge progress changing the dial on ethnicity, there is an emerging group of ‘laggards’ within the sector, who have not made any progress here: more than a third of retailers still have all-white boards, and just under that have all-white executive committees.

Looking ahead, in our conversations with the sector’s leaders, we got the clear impression that momentum on driving up ethnic diversity has also slowed. When we conducted our research last year, we were in the slipstream of the Black Lives Matter movement in 2020 – there definitely feels to be less urgency driving the agenda on ethnicity this year versus last year.

Of course, meaningful progress doesn’t happen overnight, and the effect of the new or broadened strategies may not be felt for some time. But this is no reason to sit back.

As BRC CEO Helen Dickinson explained this in a session with retail CEOs earlier this week to launch the report, it’s vital that businesses ensure they are “doing the hard stuff… unpeeling the onion and getting underneath the skin of the culture of a business, working out what’s holding them back”.

Amongst the CEOs on the call, an interesting debate opened up about the best methodology to drive meaningful change across the sector. As one CEO put it “I really wrestle with this question: do we applaud the successes and drive progress that way, or do we dramatise the lack of progress and up the urgency to push forward?”

Another CEO encouraged peers to “do stuff and talk about it less… actions – like anchoring rewards and incentives around specific interventions – speak for themselves and you see the results in the statistics”.

Our report provides five recommendations for retailers to act on in the next period:

1 – Customise D&I strategies

Businesses should align their long-term D&I strategies with insights from employee engagement efforts. D&I is not a ‘one-size-fit-all’ issue, and listening to employees will enable retailers to focus on their unique challenges and opportunities

2 – Continue to invest in data collection

Retailers should prioritise understanding their business and expanding data gathering programmes beyond gender and ethnicity to include social mobility, LGBTQ+ and disability. As we have said many times before, “what gets measured, gets changed” – and the lack of data, in certain businesses, is certainly a significant barrier to change

3 – Develop diverse talent pipelines

Focusing on increasing the number of women, people from ethnic minority backgrounds, and other diverse leaders who can step up into the most senior roles. Development programmes targeted at different groups, for example women leaders, can be highly valuable.

4 – Focus on Black leaders

Across the retail industry, there is a particular lack of Black leaders. In fact, there are only a handful of visible black leaders across the retail sector as a whole. The furthest-ahead retailers in D&I are specifically creating programmes to advance black leaders, in addition to the work they are doing on ethnicity as a whole.

5 – Set targets and measure progress

Put in place specific goals for representation of minority groups at certain levels, for example Black or female store managers.

After a week of talking various key stakeholder groups through the research – from CEOs to HR Directors and Non-Executive Directors to D&I leads – it is abundantly clear that there is a great appetite to drive progress in a significant number of retailers.

But it’s also vital that in the face of turbulent trading patterns and a cost-of-living crisis, business leaders recognise that the temptation to drop D&I as a priority would be a false economy. D&I should be recognised as part of the solution to growth and be treated as such. The time to act was yesterday, and the whole sector – and beyond, as seen in the coverage below – is watching. We look forward to seeing what progress the sector is able to make over the next 12 months.

You can download a copy of the report here, and of course we welcome any thoughts or feedback.