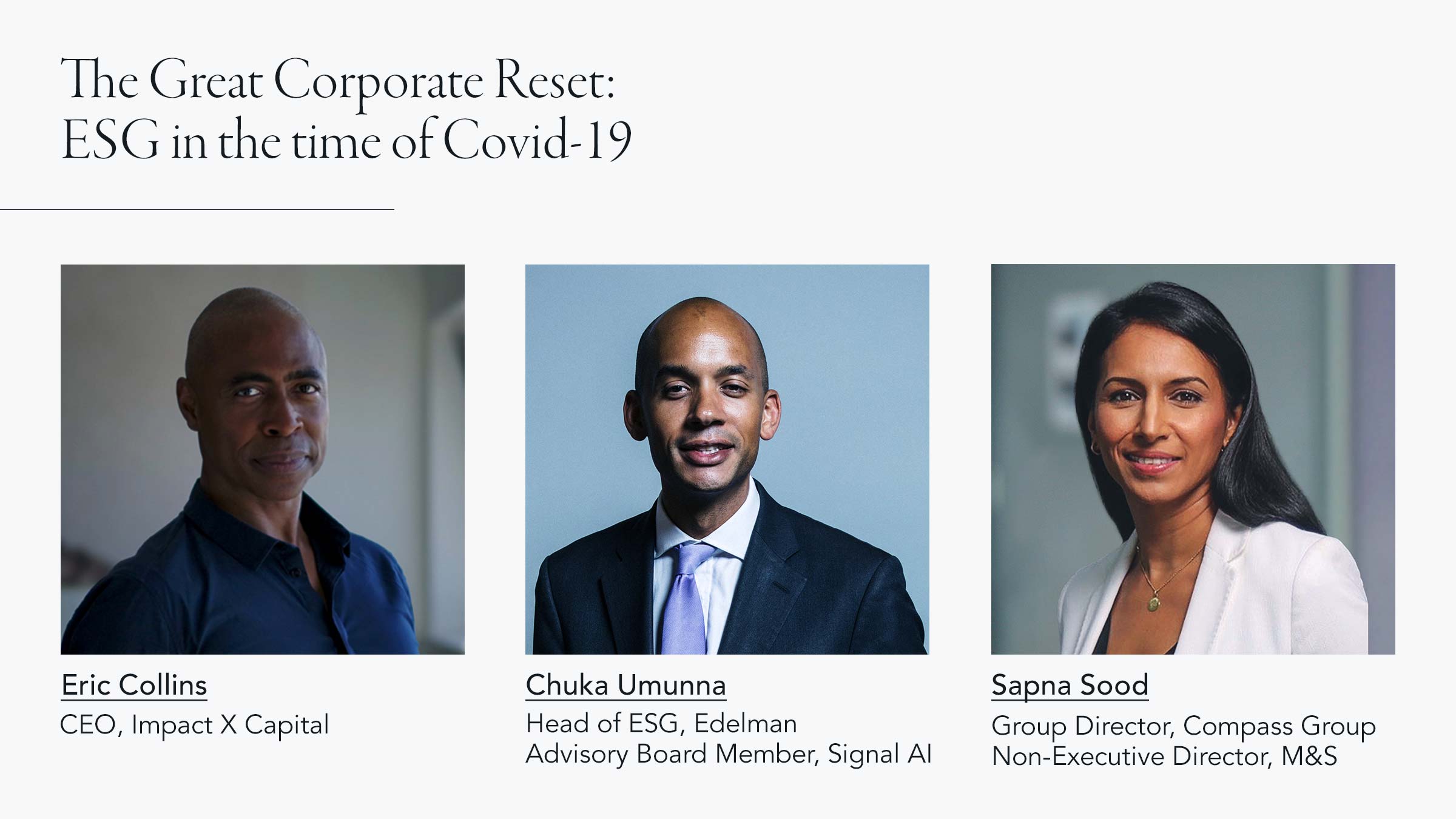

Last week, it was my privilege to be joined by a truly fantastic panel to kick off the first session of our Leadership Summit with Signal AI and Tortoise Media. A summit with three panels and 13 speakers would have taken about six months to organise pre-lockdown, but this event – attended by 400 thinkers and business leaders – was arranged in just four weeks to explore the pressing topics of leadership, AI and ESG in our new normal. Alongside me were Eric Collins, CEO and co-founder of Impact X Capital; the former politician and now Head of ESG at Edelman, Chuka Umunna, and Sapna Sood, Group Director, International Clients & Market Development at Compass Group and Non-Executive Director at Marks & Spencer.

We were gathered to discuss ESG (Environment, Social and Governance) in the time of Covid-19, and whether or not the coronavirus crisis has presented an opportunity for a great corporate reset.

I began by asking my first panellist Chuka Umunna to set the scene, defining what ESG – and the broader notion of ‘responsible capitalism’ – means to him.

“For me,” he said, “it means recognising that a company’s long-term prosperity is inextricably linked to what it delivers to its stakeholders: not just shareholders but employees, customers, suppliers and the community in which it operates. ESG is a vital piece of responsible capitalism. By definition, to work within a framework of stakeholder capitalism means integrating environmental, social, and governance factors into decision-making.” Most of all, Chuka stressed that “it’s not an either/or… you don’t have to choose between stakeholder interests and shareholder interests.”

During his time as Shadow Secretary of State for Business, Innovation and Skills (2011-2015), ESG was a topic that sat right at the centre of Chuka’s brief. I was interested to know, therefore, how much progress he felt we had made in the period since, up until the coronavirus crisis took hold.

He illustrated just how dramatically the conversation has evolved in the last decade, recalling how an entire room of the great and the good from British business had turned on him and then Labour leader Ed Miliband when they made the argument for stakeholder capitalism, labelling the pair ‘anti-business’. “But the C-suite has gone on a journey,” he reflected, “and it has come to realise that a more inclusive model of capitalism will deliver for more people and get greater results.”

While the conversation around ESG might have moved on, Eric Collins helped put the scale of the challenge into perspective. The founder and CEO of Impact X, a double bottom line venture capital firm founded to support underrepresented entrepreneurs across Europe, Eric explained that, in the nineties (when he received his first term sheet from a VC fund), just 4% of all VC capital went to women, and only 1% went to black entrepreneurs. Fast forward to today, and there has been little change – those numbers remain broadly the same. “We’re looking at the world of ESG,” Eric said, “and we’re seeing a crisis.”

“We’re looking at the world of ESG and we’re seeing a crisis.” – Eric Collins, CEO and Founder of Impact X Capital

I asked Eric why he had founded Impact X in Europe rather than his native USA. “We can have more impact in Europe,” he told us. “In the US, the businesses that are meant to be disrupting and undoing the hegemony of companies founded hundreds of years ago – Airbnb, Amazon, Netflix and Uber for example – are still incredibly old-fashioned in their leadership teams. We’re still fighting to get more women and black people into decision-making roles in Silicon Valley, and we hope to find lesser headwinds in Europe.”

I next asked Sapna Sood, who until a few months ago chaired the Sustainability Committee on the board of Kering and now sits on the board of Marks & Spencer, for her view on ESG, and where she feels we were standing pre-crisis. “I think we all recognise that when we looked at ESG pre-crisis, it was the E that was at the forefront,” she told the audience. “You couldn’t pick up a newspaper or follow any news channel and not be bombarded by news about the climate crisis and the bleak future for our planet. But during the course of Covid-19, social concerns and corporate governance have also come to the fore.”

All my panellists agreed that the last few months have forced businesses to engage in the notion of responsible capitalism and to recognise ESG in its entirety. Covid-19 and the Black Lives Matter movement have galvanised individuals, businesses and governments alike to take urgent action, and forced leaders world-over to re-think entrenched policies and values. As Chuka aptly put it: “this experience has turbo-charged the ESG conversation.”

“This experience has turbo-charged the ESG conversation” – Chuka Umunna, Head of ESG at Edelman

Chuka reflected further on the nature of Covid-19: “at the outset of the crisis, we heard people arguing that the pandemic doesn’t discriminate – that it can affect anyone. But this experience has taught us that it does discriminate, because of the environment and the society we live in.” This viewpoint felt particularly pertinent, especially when considering the conversations around key workers and social mobility that have taken place in the last few months.

But how can we harness this momentum to deliver real change? If this is an opportunity for a great corporate reset, how do we seize it? “The key question for all businesses now,” Sapna answered, “is how to take what’s happened and turn it into long-term impact. Around the world, corporates are currently rethinking their whole direction and redefining their operating models – and incorporating ESG as part of this will be crucial.”

An engineer by background, and with a wealth of experience in the industrial sectors, Sapna described the pandemic’s impact on sustainability. After all, Covid-19 has served to simultaneously slow down the urgent discussion around climate change, but also wave in a new era of more sustainable business. After being eclipsed by social concerns and corporate governance considerations at the height of the crisis, the environmental element of ESG is now being explored in a new way as the economy reopens.

“Thanks to the pandemic,” Sapna explained, “companies have had to reconsider where they’re getting their raw materials from and how they’re manufacturing their products. In many cases, this could mark a new era of local, more sustainable production – which will have an incredible impact on the environment.

“It’s going to take some effort,” Sapna warned, “but we can’t forget the lessons we’ve learnt through this period.”

“We can’t forget the lessons we’ve learnt through this period” – Sapna Sood, Group Director, Compass Group and Non-Executive Director, M&S

Perhaps most crucially, I found my panellists as passionate about the case for making financial returns as they are about the underlying ESG agenda. Describing its overarching objectives, Eric explained that Impact X spends its time “measuring the positive social impact that we can have by creating jobs. And not just any jobs – we want to create jobs for women, and for people of colour, at co-founder, C-suite and board level. We want to see diverse people with P&L responsibility, as well as in decision-making roles.”

However, he stressed that the fund’s first goal is to “look for financial return, because we believe in having a sustainable fund that people want to put money into and that will allow us to raise more money.”

Chuka reinforced the point: “it’s good for people to make lots of money through doing good, ESG-conscious things. When I read people criticising companies like Generation Investment Management, run by Al Gore and former Goldman Sachs banker David Blood, I wonder, ‘what planet are you living on?’; we need the ESG-conscious businesses in every sector to be the leader of the pack.”

Following the money, “we need to see investors pushing companies to do better,” suggested Eric. “Right now, the world’s most powerful people aren’t willing to give up their world view. Until shareholders say ‘we want to see something different’, I don’t think there’ll be much change.”

While pressure from above is a key element to inspiring transformation in businesses, there are built-in risks around this. As one of the questions from the audience pointed out, the majority of shareholders currently benefit from the current system and could therefore be the least likely to champion these issues.

Conscious of this, the panel pointed out that consumers also have a role to play. “Increasing demand also comes from citizens,” Chuka commented, “especially from millennials, who are really driving the conversation around ESG. At the moment, they have a certain amount of capital… but soon enough they’re going to start inheriting money from the baby boomers and become extremely influential.”

In his recently-released book, Impact: Reshaping Capitalism to Drive Real Change, Sir Ronald Cohen suggests that there is an opportunity for businesses to work in harmony with the state, harnessing the power of capital and innovation to solve societal and social issues. Having just finished the book myself, I asked the panellists about the role they feel that government has to play.

“There is definitely an opportunity – but the UK government isn’t getting it right yet,” Eric replied. He touched upon the UK government’s various schemes during the height of lockdown that he felt had failed to consider or cater for underrepresented groups. “I can see the intention, but I can also see that those intentions will go nowhere and simply be a waste of time if we don’t change up the people who are putting forward and implementing the plans.”

So is this the time for a great corporate reset? It is clear from our discussion that we are living through a unique time, where corporate awareness of the ESG agenda is higher than ever. By accident and by design, Covid-19 and its consequences do present an opportunity for genuine, lasting change – but it will require real energy and focus from companies, governments and consumers to seize the opportunity.

I could have talked to Eric, Sapna and Chuka for the rest of the evening, but with that it was time to pass on the baton to Alexandra Mousavizadeh, of Tortoise Media, and her expert panel to discuss the Global AI Race. More on that, and Simon Collins’ panel on AI Disruptors, in next week’s Weekend Edition.